截至2022年9月23日的財政季度(F2Q‘23)截至2022年12月23日的財政季度(F3Q’23)截至2023年3月31日的財政季度(F4Q‘23)截至2023年6月30日的財政季度(F1Q’24)截至6月30日的TTM,2023年N et S銷售總額$237.7$248.8$269.4$278.3$1,034.2銷售成本105.6 106.2 116.4 120.3 448.5毛利$132.0$142.6$153.1 158.0 585.7購入無形資產攤銷0.4 0.6 0.6 0.4 2.0基於股票的薪酬1.1 1.2 2.0 2.6 6.9非公認會計準則毛利$133.5$144.3$155.7$161.0$594.5GAAP毛利率56.2%58.0%57.8%57.8%57.5%20 GAAP對非GAAP營業毛利調整**由於四捨五入,項目總和可能不是總和

(以百萬美元為單位)截至2021年9月24日的財政季度(F2Q‘22)截至2021年12月24日的財政季度(F3Q’22)截至2022年3月25日的財政季度(F4Q‘22)截至6月24日的財政季度,2022年第一季度S銷售總額$193.6$186.6$200.3$217.8銷售成本91.1 85.5 90.7 99.4毛利(公認會計準則)$102.5$101.2$109.6$118.4購進無形資產攤銷0.3 0.3 0.3重組成本0.3-基於股票的薪酬0.7 0.7 1.2 0.8其他成本0.3 0.1 0.3-非公認會計準則毛利104.1$102。3$111.4$119.5非公認會計準則毛利53.8%54.8%55.6%54.9%21公認會計準則對非公認會計準則營業毛利調節**由於四捨五入,項目總和可能不能合計

截至2022年9月23日的財政季度(F2Q‘23)截至2022年12月23日的財政季度(F3Q’23)截至2023年3月31日的財政季度(F4Q‘23)截至2023年6月30日的財政季度(F1Q’24)截至6月30日的TTM,35.6 39.6 41.8 43.0 160.0交易相關成本0.2-0.2重組成本--0.10.1基於股票的薪酬1.7 3.2 3.5 2.9 11.2非公認會計準則研發支出33.7 36.4 38.3 40.1 148.5銷售,一般和行政費用39.1 37.4 48.3 44.2 169.0與交易有關的成本0.1-0.6 3.1 3.8購進無形資產攤銷-0.4 0.4重組成本0.1 0.3 0.5-0.9基於股票的薪酬5.4 4.6 5.1 5.6 20.6其他成本--5.9-5.9非公認會計準則銷售,一般和行政費用33.6 32.5 36.1 35.2 137.3或有對價的公允價值變動(2.5)-(0.1)-(2.6)非公認會計準則調整總額5.0 8.1 15.7 11.9 40.6非公認會計準則營業費用$67.2$68.9$74.3$75.3$285.8非公認會計準則營業費用利潤率(佔淨銷售額的百分比)28.3%27.7%27.6%27.1%27.6%22GAAP至非GAAP營業費用對賬**由於四捨五入,項目總和可能不會合計

(以百萬美元為單位)截至2021年9月24日的財政季度(F2Q‘22)截至2021年12月24日的財政季度(F3Q’22)截至2022年3月25日的財政季度(F4Q‘22)截至6月24日的財政季度,2022年(F1Q‘23)營業費用(GAAP)$64.0$65.6$79.4$103.6研發費用(GAAP)29.6 30.3 32.4 33.9與交易相關的成本-0.2股票薪酬1.0 1.0 1.1 1.1非GAAP研發費用28.5 29.3 31.3 32.5銷售,一般和行政費用(GAAP)34.1 38.0 46.8 70.0交易相關成本-1.1 0.4 1.6重組成本0.2 0.7-4.3基於股票的薪酬4.4 5.9 12.6 32.2其他成本0.6 0.4 0.2-非GAAP銷售,一般和行政費用28.9 30.0 33.5 31.9或有對價的公允價值變動0.3(2.7)0.1(0.2)非GAAP調整總額6.5 6.3 14.5 39.2非GAAP營業費用$57.5$59.2$64.8$64.4非GAAP營業費用毛利(佔淨銷售額的百分比)29.7%31.7%32.4%29.6%23 GAAP至非GAAP營業費用對賬**由於四捨五入,項目總和可能不是總和

截至2022年9月23日的財政季度(F2Q‘23)截至2022年12月23日的財政季度(F3Q’23)截至2023年3月31日的財政季度(F4Q‘23)截至2023年6月30日的財政季度(F1Q’24)截至6月30日的TTM,2023年營業收入$59.8$65.6$63.1$70.7$259.3與交易相關的成本(2.2)-0.5 3.1 1.4購進無形資產攤銷0.4 0.6 0.6 0.8 2.4重組成本0.1 0.3 0.6-0.9股票薪酬8.9 10.6 11.0 38.7其他成本--5.9-5.9非公認會計準則營業收入$66.3$75.5$81.4$85.6$308.8非公認會計準則營業利潤率(佔淨銷售額的百分比)27.9%30.3%30.2%30.8%29.9%24公認會計準則對非公認會計準則營業收入調節**由於四捨五入原因,項目總和可能不是總和

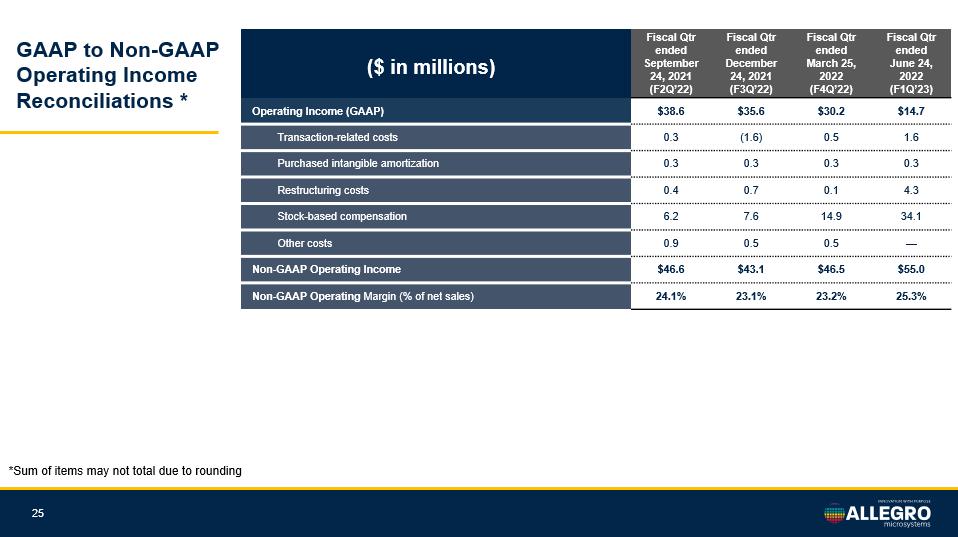

(以百萬美元為單位)截至2021年9月24日的財政季度(F2Q‘22)截至2021年12月24日的財政季度(F3Q’22)截至2022年3月25日的財政季度(F4Q‘22)截至6月24日的財政季度,2022年第一季度營業收入(GAAP)$38.6$35.6$30.2$14.7與交易相關的成本0.3(1.6)0.5 1.6購入無形資產攤銷0.3 0.3 0.3重組成本0.4 0.7 0.1 4.3基於股票的薪酬6.2 7.6 14.9 34.1其他成本0.9 0.5-非GAAP營業收入$46.6$43.1$46.5$55.0利潤率(佔淨銷售額的百分比)24.1%23.1%23.2%25.3%25 GAAP對非GAAP營業收入調節**由於四捨五入,項目總和可能不是總和

截至2022年9月23日的財政季度(F2Q‘23)截至2022年12月23日的財政季度(F3Q’23)截至2023年3月31日的財政季度(F4Q‘23)截至2023年6月30日的財政季度(F1Q’24)截至6月30日的TTM,淨收益(GAAP)$50.6$64.6$62.0$60.9$238.1稀釋後每股收益(GAAP)$0.26$0.33$0.32$0.31$1.22與交易相關的成本(2.2)-0.5 3.1 1.4外購無形攤銷0.4 0.6 0.6 0.8 2.4重組成本0.1 0.3 0.6-0.9基於股票的薪酬8.2 8.9 10.6 11.0 38.7非公認會計準則淨收益$59.8$68.8$71.6$76.5$276.7攤薄加權平均普通股192.6 193.9 195.0 195.0 194.3非公認會計準則攤薄每股收益$0.31$0.35$0.37$0.39$1.42 26公認會計準則對非公認會計準則每股收益調整**由於四捨五入,項目總和可能不是總和

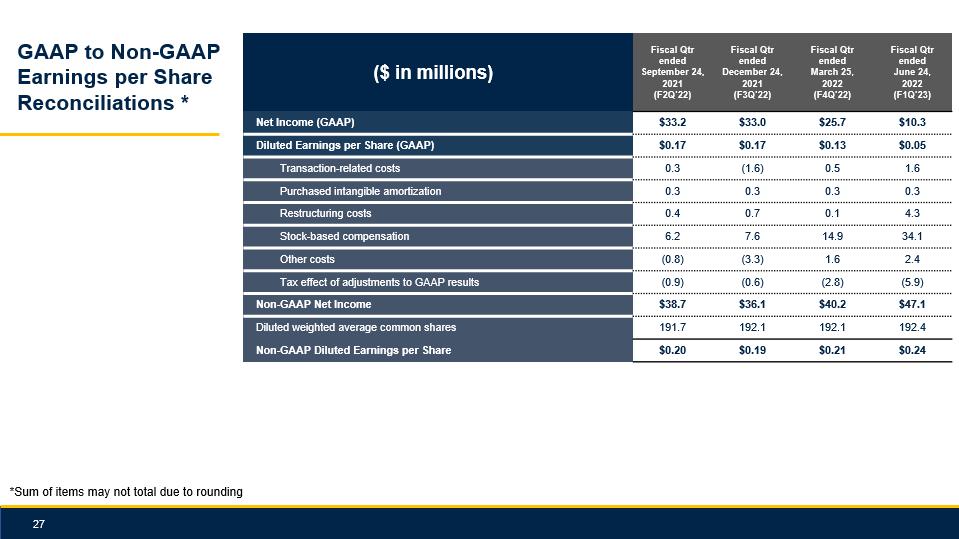

(以百萬美元為單位)截至2021年9月24日的財政季度(F2Q‘22)截至2021年12月24日的財政季度(F3Q’22)截至2022年3月25日的財政季度(F4Q‘22)截至6月24日的財政季度,2022年第一季度淨收入(GAAP)$33.2$33.0$25.7$10.3稀釋後每股收益(GAAP)$0.17$0.17$0.13$0.05交易相關成本0.3(1.6)0.5 1.6購入無形資產攤銷0.3 0.3 0.3重組成本0.4 0.7 0.1 4.3股票薪酬6.2 7.6 14.9 34.1其他成本(0.8)(3.3)1.6 2.4對公認會計準則結果的調整對税收的影響(0.9)(0.6)(2.8)(5.9)非公認會計準則淨收入$38.7$36.1$40.2$47.1攤薄加權平均普通股191.7 192.1 192.1 192.4非公認會計準則攤薄每股收益$0.2$0.19$0.21$0.24 27公認會計準則對非公認會計準則每股收益的調整**由於四捨五入,項目總和可能不能總計

28年度股東大會2021年8月公司演示文稿謝謝

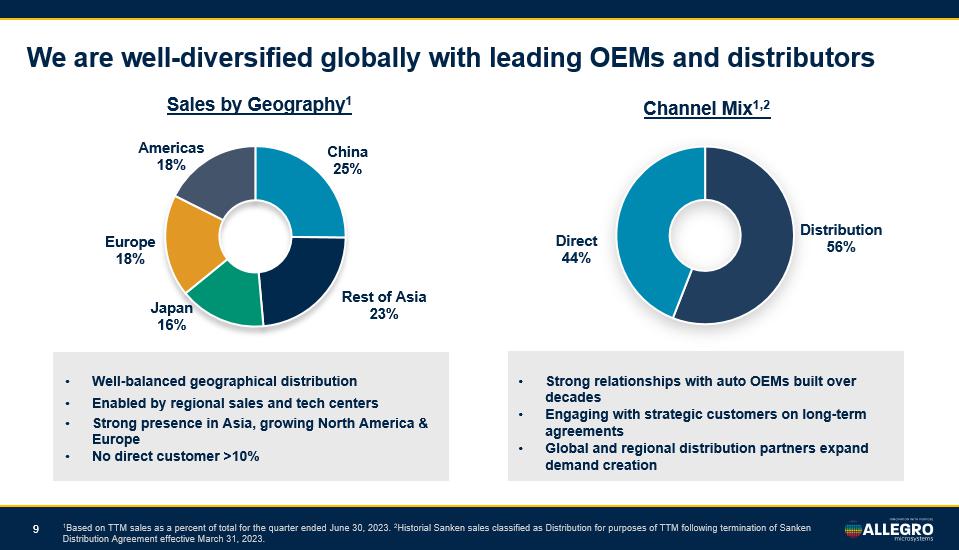

We are well - diversified globally with leading OEMs and distributors 1 Based on TTM sales as a percent of total for the quarter ended June 30, 2023. 2 Historial Sanken sales classified as Distribution for purposes of TTM following termination of Sanken Distribution Agreement effective March 31, 2023. Distribution 56% Direct 44% Channel Mix 1,2 • Strong relationships with auto OEMs built over decades • Engaging with strategic customers on long - term agreements • Global and regional distribution partners expand demand creation • Well - balanced geographical distribution • Enabled by regional sales and tech centers • Strong presence in Asia, growing North America & Europe • No direct customer >10% China 25% Rest of Asia 23% Japan 16% Europe 18% Americas 18% Sales by Geography 1 9

Our ESG initiatives are integral to our strategy 10 Issued Inaugural ESG Report July 2023 We are moving the world to a safer and more sustainable future • Minimize our impact on the planet • Engage our supply chain to advance sustainability • Build a diverse & innovative workforce • Cultivate opportunities in local communities

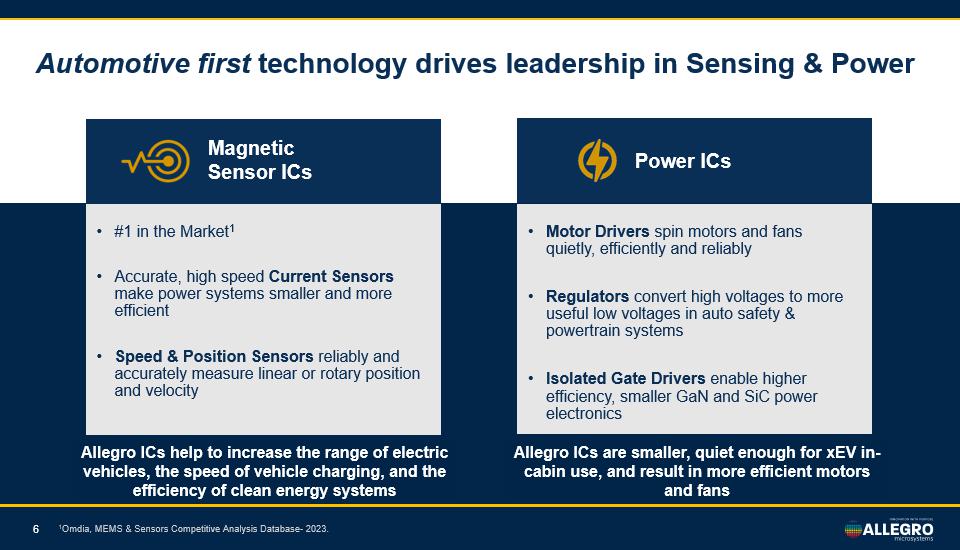

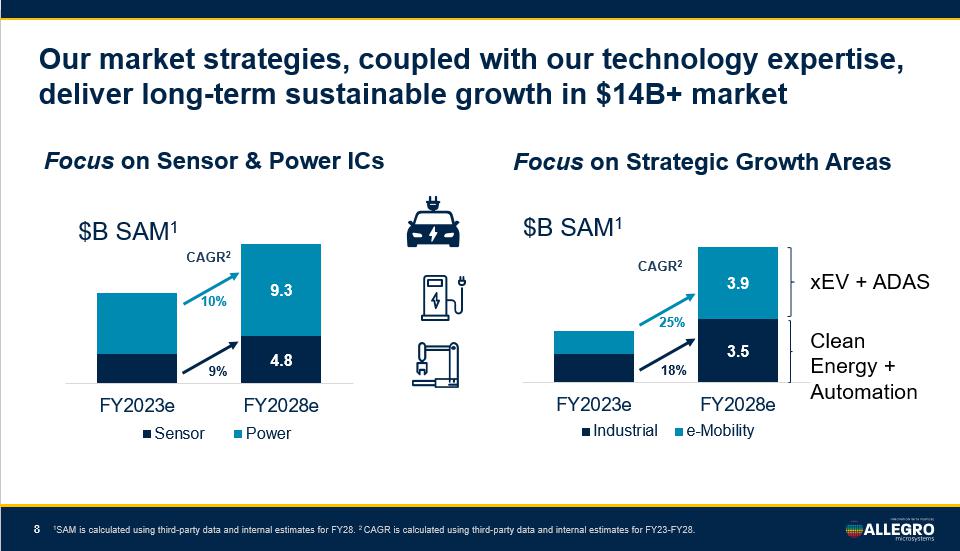

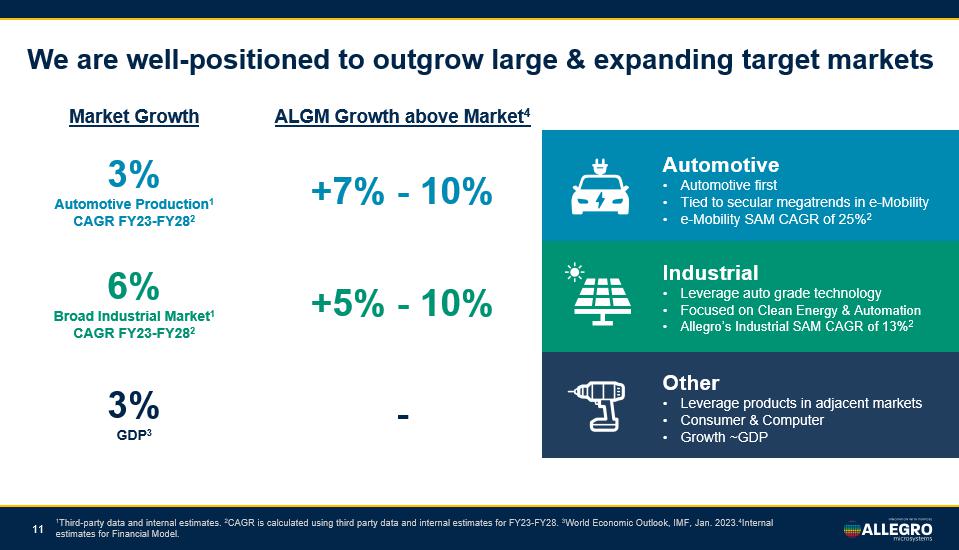

Industrial • Leverage auto grade technology • Focused on Clean Energy & Automation • Allegro’s Industrial SAM CAGR of 13% 2 Other • Leverage products in adjacent markets • Consumer & Computer • Growth ~GDP Automotive • Automotive first • Tied to secular megatrends in e - Mobility • e - Mobility SAM CAGR of 25% 2 We are well - positioned to outgrow large & expanding target markets 1 Third - party data and internal estimates. 2 CAGR is calculated using third party data and internal estimates for FY23 - FY28. 3 World Economic Outlook, IMF, Jan. 2023. 4 Internal estimates for Financial Model. Market Growth ALGM Growth above Market 4 3% Automotive Production 1 CAGR FY23 - FY28 2 +7% - 10% 6% Broad Industrial Market 1 CAGR FY23 - FY28 2 +5% - 10% 3% GDP 3 - 11

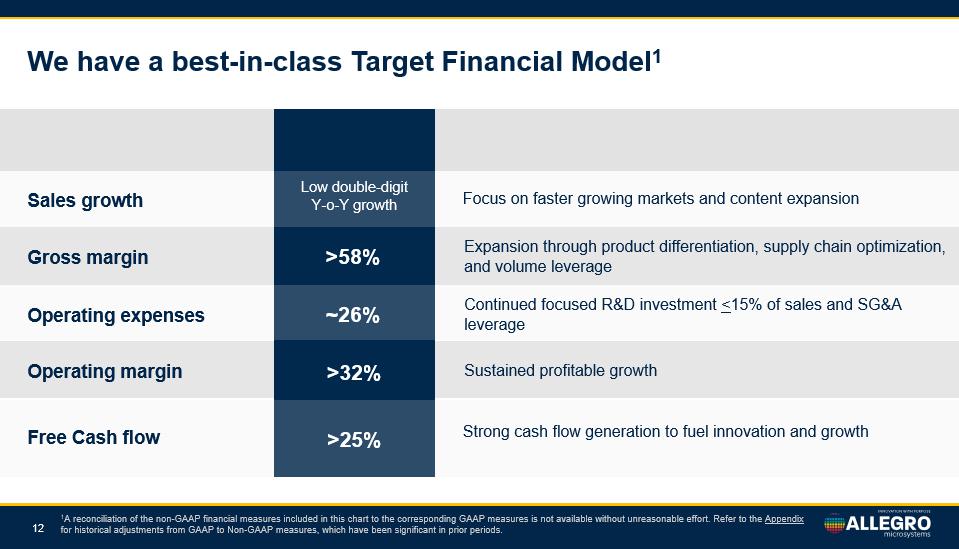

Gross margin Operating margin Expansion through product differentiation, supply chain optimization, and volume leverage Sustained profitable growth >58% >32% Sales growth Focus on faster growing markets and content expansion Low double - digit Y - o - Y growth Operating expenses Continued focused R&D investment 25% Strong cash flow generation to fuel innovation and growth We have a best - in - class Target Financial Model 1 1 A reconciliation of the non - GAAP financial measures included in this chart to the corresponding GAAP measures is not available w ithout unreasonable effort. Refer to the Appendix for historical adjustments from GAAP to Non - GAAP measures, which have been significant in prior periods. 12

Maintain Strong & Flexible Balance Sheet Our investment and capital allocation strategy • Deliver strong and growing cash flow • Retain financial flexibility to pursue growth opportunities • Maintain strong balance sheet and adequate liquidity Investment in Organic Growth • Investments in R&D and capital expenditures to drive innovation and technology leadership • Expanding sales and partner network to enhance customer intimacy • ROIC - based investment decisions Focused M&A • Accelerate growth in our Strategic Growth Areas • Complementary to our expertise and customer base • Accretive to Target Financial Model 13

Accelerating Allegro’s innovation in TMR Sensing technology Allegro MicroSystems (“Allegro”) to acquire Crocus Technology (“Crocus”) 14

15 Acquisition accelerates roadmap & momentum in e - Mobility & Clean Energy Best - in - class, innovative TMR technology for Magnetic Sensor ICs Transaction well - aligned with M&A strategy articulated at Analyst Day Highly complementary to Allegro’s products and technology supported by more than 200 patents Strengthens Allegro’s ability to support highest growth applications in e - Mobility, Clean Energy and Automation Allegro is well positioned to strengthen Crocus’ position in Industrial markets and introduce Crocus' technology to Automotive markets 15

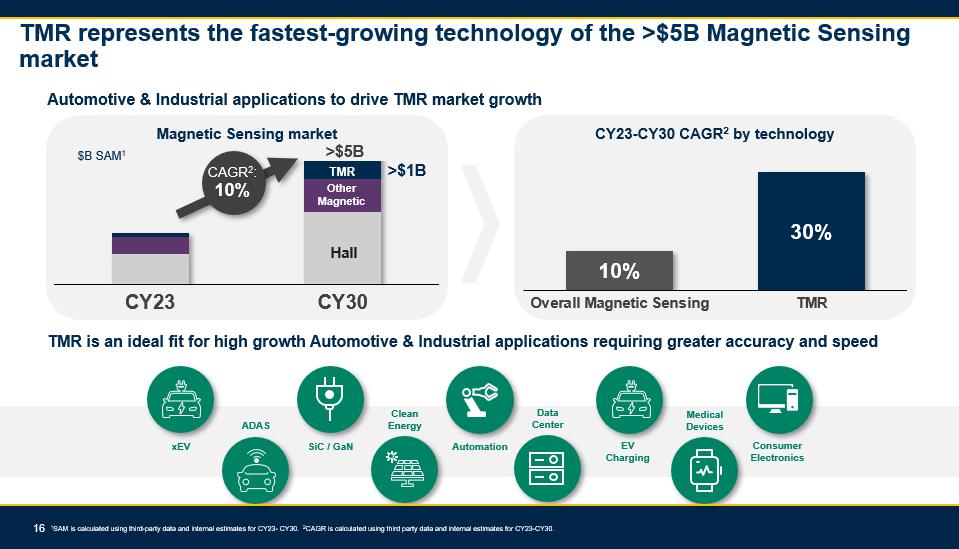

16 TMR represents the fastest - growing technology of the >$5B Magnetic Sensing market Automotive & Industrial applications to drive TMR market growth TMR is an ideal fit for high growth Automotive & Industrial applications requiring greater accuracy and speed xEV ADAS SiC / GaN Automation Clean Energy EV Charging Data Center Consumer Electronics Medical Devices 1 SAM is calculated using third - party data and internal estimates for CY23 - CY30. 2 CAGR is calculated using third party data and internal estimates for CY23 - CY30. 10% 30% Overall Magnetic Sensing TMR CY23 - CY30 CAGR 2 by technology CY23 CY30 CAGR 2 : 10% Magnetic Sensing market $B SAM 1 >$5B Hall Other Magnetic TMR >$1B 16

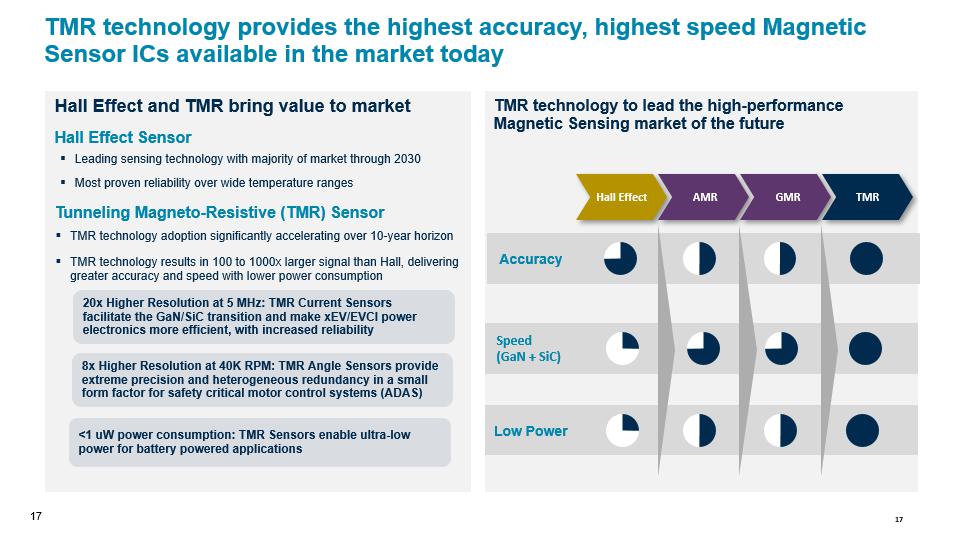

17 TMR technology provides the highest accuracy, highest speed Magnetic Sensor ICs available in the market today TMR technology to lead the high - performance Magnetic Sensing market of the future Hall Effect and TMR bring value to market Hall Effect AMR GMR TMR ▪ Leading sensing technology with majority of market through 2030 ▪ Most proven reliability over wide temperature ranges ▪ TMR technology adoption significantly accelerating over 10 - year horizon ▪ TMR technology results in 100 to 1000x larger signal than Hall, delivering greater accuracy and speed with lower power consumption Hall Effect Sensor Tunneling Magneto - Resistive (TMR) Sensor 20x Higher Resolution at 5 MHz: TMR Current Sensors facilitate the GaN / SiC transition and make xEV /EVCI power electronics more efficient, with increased reliability 8x Higher Resolution at 40K RPM: TMR Angle Sensors provide extreme precision and heterogeneous redundancy in a small form factor for safety critical motor control systems (ADAS)

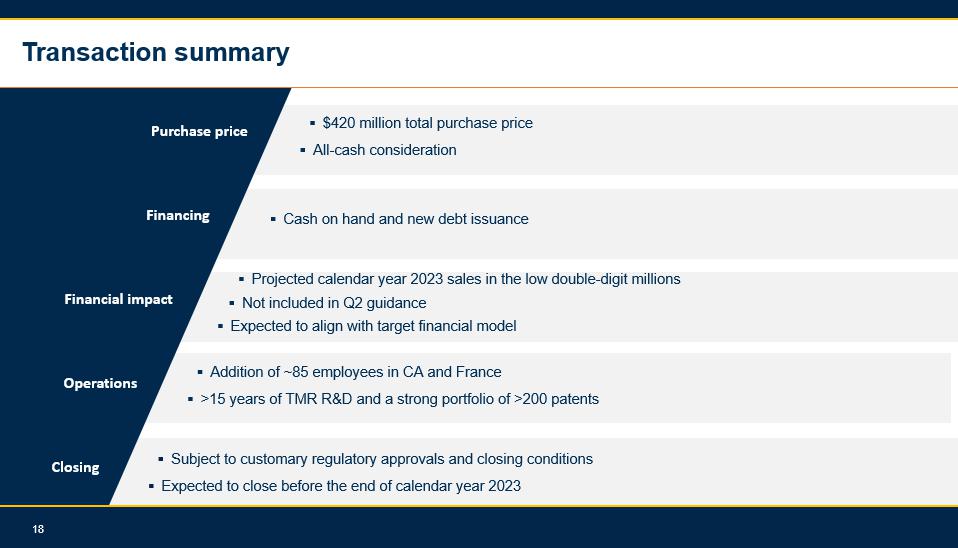

18 ▪ $420 million total purchase price ▪ All - cash consideration ▪ Cash on hand and new debt issuance ▪ Subject to customary regulatory approvals and closing conditions ▪ Expected to close before the end of calendar year 2023 Transaction summary Purchase price Financing Financial impact Closing ▪ Addition of ~85 employees in CA and France ▪ >15 years of TMR R&D and a strong portfolio of >200 patents Operations ▪ Projected calendar year 2023 sales in the low double - digit millions ▪ Not included in Q2 guidance ▪ Expected to align with target financial model 18

19 Annual Shareholder Meeting Company Presentation August 2021 GAAP to Non - GAAP Reconciliations

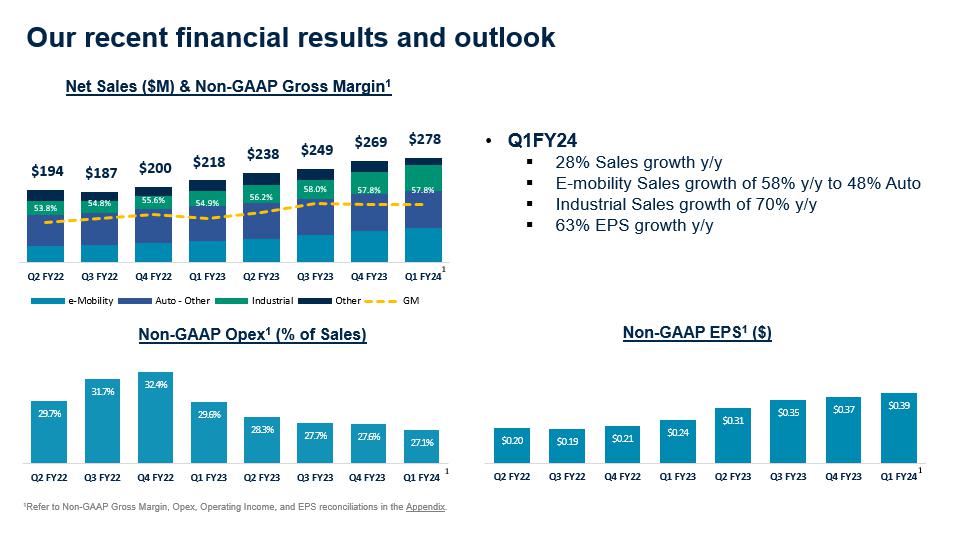

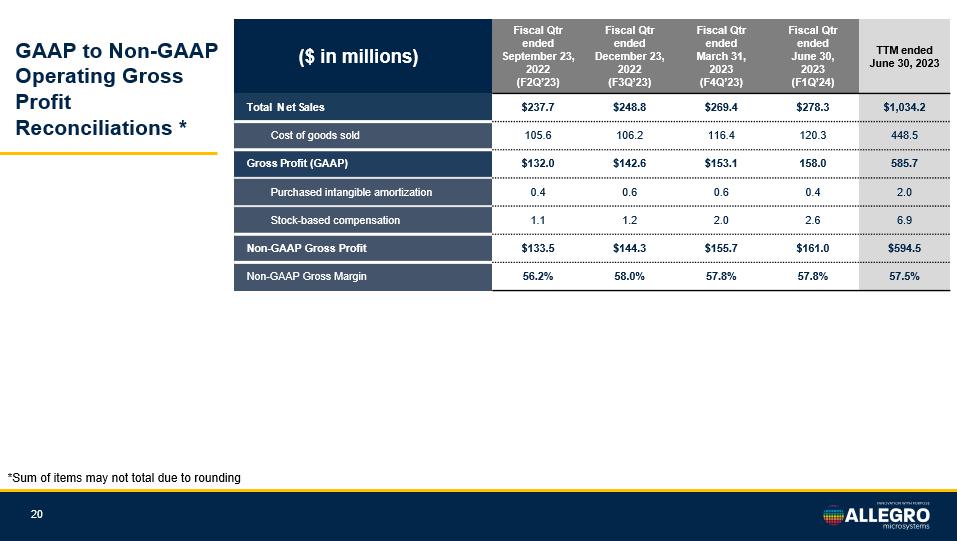

($ in millions) Fiscal Qtr ended September 23, 2022 (F2Q’23) Fiscal Qtr ended December 23, 2022 (F3Q’23) Fiscal Qtr ended March 31, 2023 (F4Q’23) Fiscal Qtr ended June 30, 2023 (F1Q’24) TTM ended June 30, 2023 Total N et S ales $237.7 $248.8 $269.4 $278.3 $1,034.2 Cost of goods sold 105.6 106.2 116.4 120.3 448.5 Gross P rofit (GAAP) $132.0 $142.6 $153.1 158.0 585.7 Purchased intangible amortization 0.4 0.6 0.6 0.4 2.0 Stock - based compensation 1.1 1.2 2.0 2.6 6.9 Non - GAAP Gross Profit $133.5 $144.3 $155.7 $161.0 $594.5 Non - GAAP Gross Margin 56.2% 58.0% 57.8% 57.8% 57.5% 20 GAAP to Non - GAAP Operating Gross Profit Reconciliations * *Sum of items may not total due to rounding

($ in millions) Fiscal Qtr ended September 24, 2021 (F2Q’22) Fiscal Qtr ended December 24, 2021 (F3Q’22) Fiscal Qtr ended March 25, 2022 (F4Q’22) Fiscal Qtr ended June 24, 2022 (F1Q’23) Total N et S ales $193.6 $186.6 $200.3 $217.8 Cost of goods sold 91.1 85.5 90.7 99.4 Gross P rofit (GAAP) $102.5 $101.2 $109.6 $118.4 Purchased intangible amortization 0.3 0.3 0.3 0.3 Restructuring costs 0.3 — — — Stock - based compensation 0.7 0.7 1.2 0.8 Other costs 0.3 0.1 0.3 — Non - GAAP Gross Profit $104.1 $102.3 $111.4 $119.5 Non - GAAP Gross Margin 53.8% 54.8% 55.6% 54.9% 21 GAAP to Non - GAAP Operating Gross Profit Reconciliations * *Sum of items may not total due to rounding

($ in millions) Fiscal Qtr ended September 23, 2022 (F2Q’23) Fiscal Qtr ended December 23, 2022 (F3Q’23) Fiscal Qtr ended March 31, 2023 (F4Q’23) Fiscal Qtr ended June 30, 2023 (F1Q’24) TTM ended June 30, 2023 Operating Expenses (GAAP) $72.2 $77.0 $90.0 $87.2 $326.3 Research and Development Expenses (GAAP) 35.6 39.6 41.8 43.0 160.0 Transaction - related costs 0.2 — — — 0.2 Restructuring costs — — 0.1 — 0.1 Stock - based compensation 1.7 3.2 3.5 2.9 11.2 Non - GAAP Research and Development Expenses 33.7 36.4 38.3 40.1 148.5 Selling, General and Administrative Expenses (GAAP) 39.1 37.4 48.3 44.2 169.0 Transaction - related costs 0.1 — 0.6 3.1 3.8 Purchased intangible amortization — — — 0.4 0.4 Restructuring costs 0.1 0.3 0.5 — 0.9 Stock - based compensation 5.4 4.6 5.1 5.6 20.6 Other costs — — 5.9 — 5.9 Non - GAAP Selling, General and Administrative Expenses 33.6 32.5 36.1 35.2 137.3 Change in fair value of contingent consideration (2.5) — (0.1) — (2.6) Total Non - GAAP Adjustments 5.0 8.1 15.7 11.9 40.6 Non - GAAP Operating Expenses $67.2 $68.9 $74.3 $75.3 $285.8 Non - GAAP Operating Expenses Margin (% of net sales) 28.3% 27.7% 27.6% 27.1% 27.6% 22 GAAP to Non - GAAP Operating Expenses Reconciliations * *Sum of items may not total due to rounding

($ in millions) Fiscal Qtr ended September 24, 2021 (F2Q’22) Fiscal Qtr ended December 24, 2021 (F3Q’22) Fiscal Qtr ended March 25, 2022 (F4Q’22) Fiscal Qtr ended June 24, 2022 (F1Q’23) Operating Expenses (GAAP) $64.0 $65.6 $79.4 $103.6 Research and Development Expenses (GAAP) 29.6 30.3 32.4 33.9 Transaction - related costs — — — 0.2 Stock - based compensation 1.0 1.0 1.1 1.1 Non - GAAP Research and Development Expenses 28.5 29.3 31.3 32.5 Selling, General and Administrative Expenses (GAAP) 34.1 38.0 46.8 70.0 Transaction - related costs — 1.1 0.4 1.6 Restructuring costs 0.2 0.7 — 4.3 Stock - based compensation 4.4 5.9 12.6 32.2 Other costs 0.6 0.4 0.2 — Non - GAAP Selling, General and Administrative Expenses 28.9 30.0 33.5 31.9 Change in fair value of contingent consideration 0.3 (2.7) 0.1 (0.2) Total Non - GAAP Adjustments 6.5 6.3 14.5 39.2 Non - GAAP Operating Expenses $57.5 $59.2 $64.8 $64.4 Non - GAAP Operating Expenses Margin (% of net sales) 29.7% 31.7% 32.4% 29.6% 23 GAAP to Non - GAAP Operating Expenses Reconciliations * *Sum of items may not total due to rounding

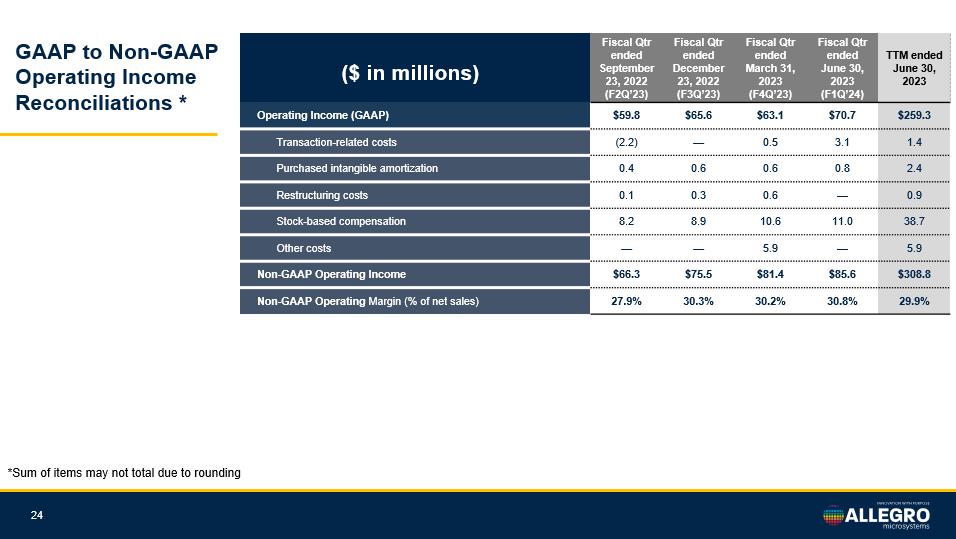

($ in millions) Fiscal Qtr ended September 23, 2022 (F2Q’23) Fiscal Qtr ended December 23, 2022 (F3Q’23) Fiscal Qtr ended March 31, 2023 (F4Q’23) Fiscal Qtr ended June 30, 2023 (F1Q’24) TTM ended June 30, 2023 Operating Income (GAAP) $59.8 $65.6 $63.1 $70.7 $259.3 Transaction - related costs (2.2) — 0.5 3.1 1.4 Purchased intangible amortization 0.4 0.6 0.6 0.8 2.4 Restructuring costs 0.1 0.3 0.6 — 0.9 Stock - based compensation 8.2 8.9 10.6 11.0 38.7 Other costs — — 5.9 — 5.9 Non - GAAP Operating Income $66.3 $75.5 $81.4 $85.6 $308.8 Non - GAAP Operating Margin (% of net sales) 27.9% 30.3% 30.2% 30.8% 29.9% 24 GAAP to Non - GAAP Operating Income Reconciliations * *Sum of items may not total due to rounding

($ in millions) Fiscal Qtr ended September 24, 2021 (F2Q’22) Fiscal Qtr ended December 24, 2021 (F3Q’22) Fiscal Qtr ended March 25, 2022 (F4Q’22) Fiscal Qtr ended June 24, 2022 (F1Q’23) Operating Income (GAAP) $38.6 $35.6 $30.2 $14.7 Transaction - related costs 0.3 (1.6) 0.5 1.6 Purchased intangible amortization 0.3 0.3 0.3 0.3 Restructuring costs 0.4 0.7 0.1 4.3 Stock - based compensation 6.2 7.6 14.9 34.1 Other costs 0.9 0.5 0.5 — Non - GAAP Operating Income $46.6 $43.1 $46.5 $55.0 Non - GAAP Operating Margin (% of net sales) 24.1% 23.1% 23.2% 25.3% 25 GAAP to Non - GAAP Operating Income Reconciliations * *Sum of items may not total due to rounding

($ in millions) Fiscal Qtr ended September 23, 2022 (F2Q’23) Fiscal Qtr ended December 23, 2022 (F3Q’23) Fiscal Qtr ended March 31, 2023 (F4Q’23) Fiscal Qtr ended June 30, 2023 (F1Q’24) TTM ended June 30, 2023 Net Income (GAAP) $50.6 $64.6 $62.0 $60.9 $238.1 Diluted Earnings per Share (GAAP) $0.26 $0.33 $0.32 $0.31 $1.22 Transaction - related costs (2.2) — 0.5 3.1 1.4 Purchased intangible amortization 0.4 0.6 0.6 0.8 2.4 Restructuring costs 0.1 0.3 0.6 — 0.9 Stock - based compensation 8.2 8.9 10.6 11.0 38.7 Other costs 1.0 (6.0) 0.8 4.6 0.4 Tax effect of adjustments to GAAP results 1.7 0.5 (3.5) (3.8) (5.2) Non - GAAP Net Income $59.8 $68.8 $71.6 $76.5 $276.7 Diluted weighted average common shares 192.6 193.9 195.0 195.0 194.3 Non - GAAP Diluted Earnings per Share $0.31 $0.35 $0.37 $0.39 $1.42 26 GAAP to Non - GAAP Earnings per Share Reconciliations * *Sum of items may not total due to rounding

($ in millions) Fiscal Qtr ended September 24, 2021 (F2Q’22) Fiscal Qtr ended December 24, 2021 (F3Q’22) Fiscal Qtr ended March 25, 2022 (F4Q’22) Fiscal Qtr ended June 24, 2022 (F1Q’23) Net Income (GAAP) $33.2 $33.0 $25.7 $10.3 Diluted Earnings per Share (GAAP) $0.17 $0.17 $0.13 $0.05 Transaction - related costs 0.3 (1.6) 0.5 1.6 Purchased intangible amortization 0.3 0.3 0.3 0.3 Restructuring costs 0.4 0.7 0.1 4.3 Stock - based compensation 6.2 7.6 14.9 34.1 Other costs (0.8) (3.3) 1.6 2.4 Tax effect of adjustments to GAAP results (0.9) (0.6) (2.8) (5.9) Non - GAAP Net Income $38.7 $36.1 $40.2 $47.1 Diluted weighted average common shares 191.7 192.1 192.1 192.4 Non - GAAP Diluted Earnings per Share $0.20 $0.19 $0.21 $0.24 27 GAAP to Non - GAAP Earnings per Share Reconciliations * *Sum of items may not total due to rounding

28 Annual Shareholder Meeting Company Presentation August 2021 Thank you