20问答嘉莉·安德森餐饮事业部执行副总裁兼首席财务官马克·克劳斯总裁&首席执行官米克·比奎森&总裁

21附录

22非公认会计准则财务指标本演示文稿包括未根据U。S。公认会计原则(“公认会计原则”)。Campbell在本报告中使用了Sovos Brands调整后的EBITDA和有机净销售额,这是非GAAP衡量标准。对于这些非GAAP财务指标中的每一个,我们在下面对非GAAP指标和最具可比性的GAAP指标之间的差异进行了协调。这些非GAAP指标应被视为可比GAAP指标的补充,而不是替代。Campbell在本报告中讨论的预计杠杆仅涉及管理层对Sovos Brands交易未来影响的预期,没有提供这些前瞻性预期杠杆预期与大多数直接可比的GAAP指标的协调,这是因为在预测和量化此类协调所需的某些金额方面存在固有困难,包括可能对养老金和退休后计划的精算损益进行调整,因为这些影响取决于市场状况、交易和整合成本以及Campbell对历史数字协调中反映的其他费用的未来变化,根据历史经验,这些金额可能会很大。

23公认会计原则和非公认会计原则财务措施的对账*(1)包括与向非雇员高级职员、董事和雇员提供基于股权的薪酬有关的非现金股权薪酬支出。(2)包括与组织优化和资本市场活动有关的专业费用;(3)包括外币合同的未实现收益。(4)包括与包装优化相关的减记,以及将联合包装生产从国际供应商转移到国内供应商的战略举措。(5)包括与剥离Birch Bders品牌相关的成本以及与潜在交易(包括即将进行的合并)相关的某些相关资产和成本。*基于Sovos Brands 2023年7月1日的财务信息。(千美元)截至2023年7月1日的12个月净亏损$(13,988)利息支出33,495所得税支出1,381折旧和摊销36,521 EBITDA$57,409非现金股权薪酬(1)21,731非经常性成本(2)3,684外币合同收益(3)(266)供应链优化(4)1,238交易和整合成本(5)53,840调整后的EBITDA$137,636 Sovos Brands--截至2023年7月1日的12个月

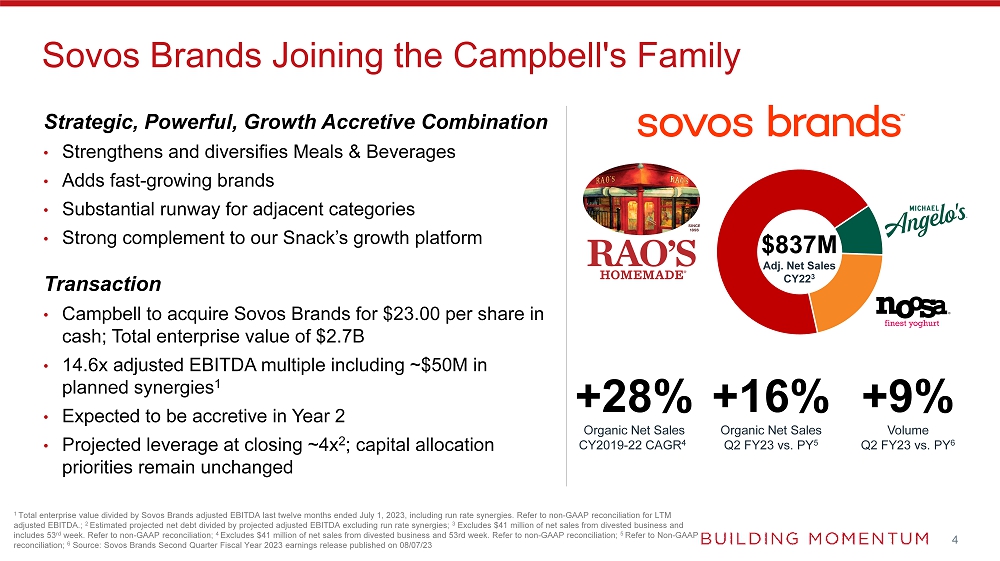

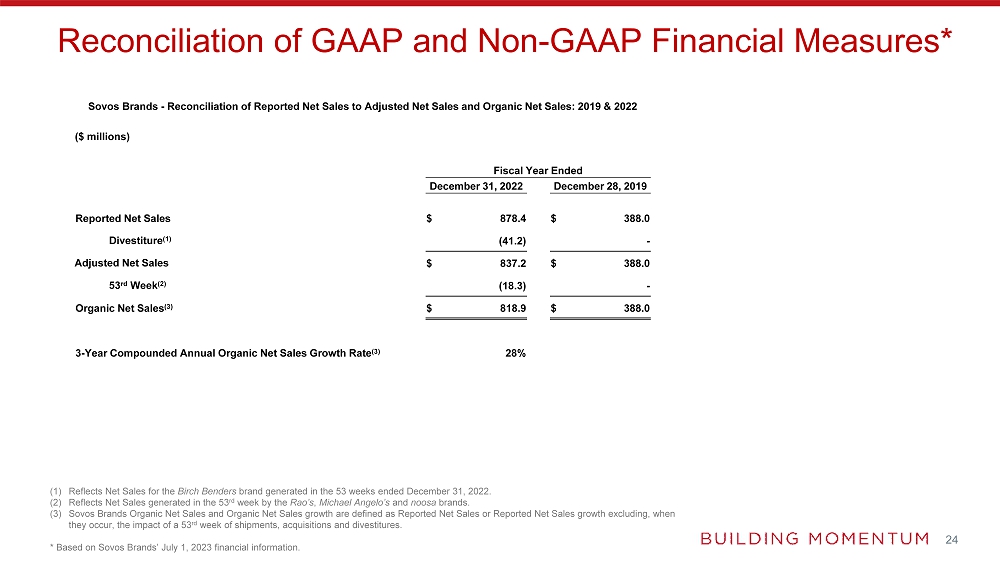

24 GAAP和非GAAP财务指标的对账*(1)反映了Birch Bders品牌在截至2022年12月31日的53周内产生的净销售额。(2)反映Rao‘s、Michael Angelo’s和Noosa品牌在第53周产生的净销售额。(3)Sovos Brands有机净销售额和有机净销售额增长被定义为报告的净销售额或报告的净销售额增长,当它们发生时,不包括第53周发货、收购和资产剥离的影响。*基于Sovos Brands 2023年7月1日的财务信息。(百万美元)截至2019年12月31日的财政年度报告净销售额$878.4$388.0资产剥离(1)(41.2)-调整后净销售额$837.2$388.0第53周(2)(18.3)-有机净销售额(3)$818.9$388.0 3年复合有机净销售额增长率(3)28%索沃斯品牌-报告净销售额与调整后净销售额和有机净销售额的对账:2019年和2022年

25公认会计准则和非公认会计准则财务指标的对账*(千美元)截至2022年7月1日的13周报告净销售额$217,635$197,433剥离(1)-(10,347)有机净销售额(2)$217,635$187,086有机净销售额增长(2)16%索沃斯品牌-报告净销售额与有机净销售额的对账:2022年第二季度和2023年第二季度(1)反映了S在截至2022年6月25日的13周内为桦木弯管机品牌产生的净销售额。(2)Sovos Brands有机净销售额和有机净销售额增长被定义为报告的净销售额或报告的净销售额增长,当它们发生时,不包括第53周发货、收购和资产剥离的影响。在讨论2023财年业绩时,有机净销售额增长不包括Birch Bders资产剥离和上一年第53周的影响。*基于Sovos Brands 2023年7月1日的财务信息。

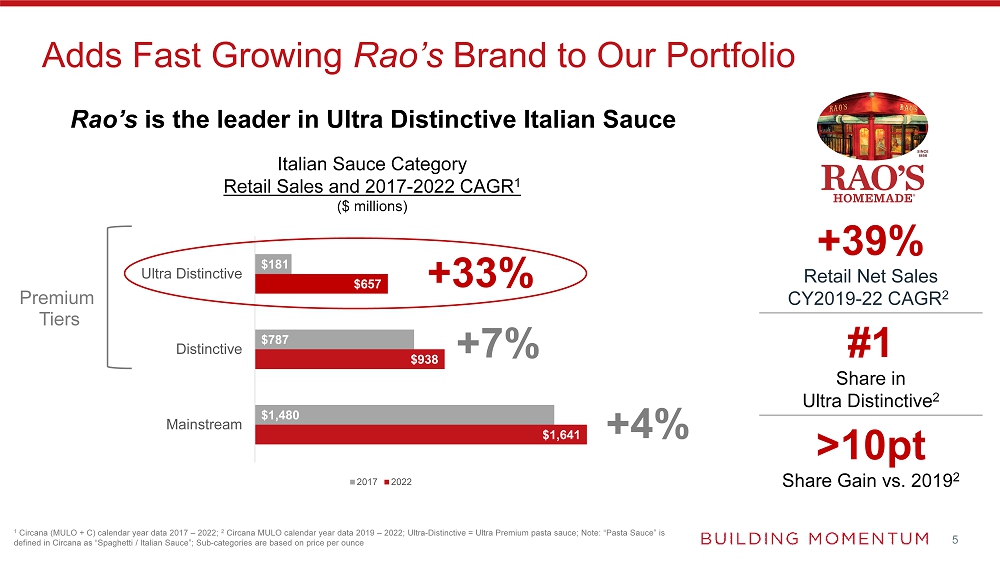

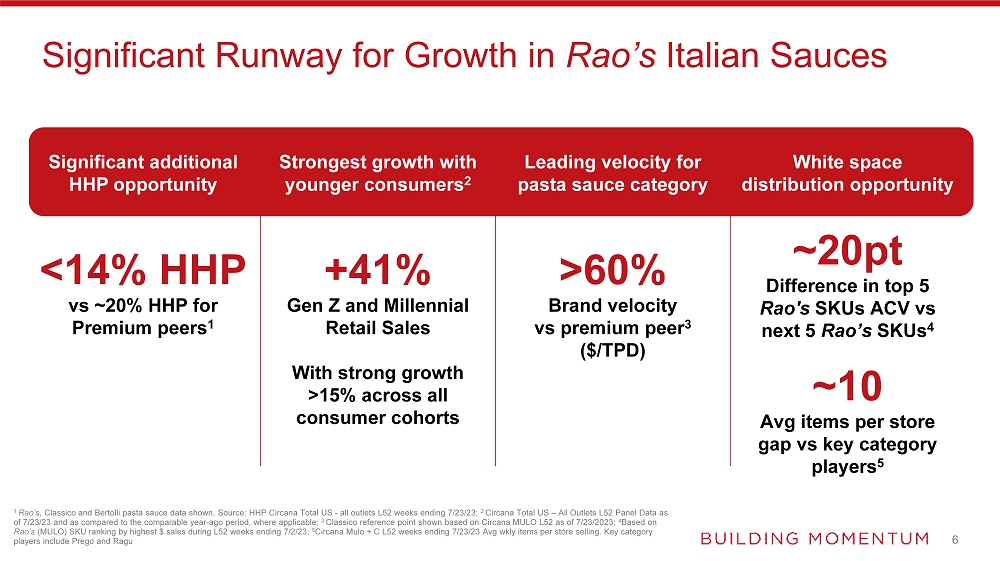

6 Significant Runway for Growth in Rao’s Italian Sauces 1 Rao’s , Classico and Bertolli pasta sauce data shown, Source: HHP Circana Total US - all outlets L52 weeks ending 7/23/23; 2 Circana Total US – All Outlets L52 Panel Data as of 7/23/23 and as compared to the comparable year - ago period, where applicable; 3 Classico reference point shown based on Circana MULO L52 as of 7/23/2023; 4 Based on Rao’s ( MULO ) SKU ranking by highest $ sales during L52 weeks ending 7/2/23; 5 Circana Mulo + C L52 weeks ending 7/23/23 Avg wkly items per store selling. Key category players include Prego and Ragu Significant additional HHP opportunity 15% across all consumer cohorts Leading velocity for pasta sauce category >60% Brand velocity vs premium peer 3 ($/TPD) White space distribution opportunity ~20pt Difference in top 5 Rao's SKUs ACV vs next 5 Rao’s SKUs 4 ~10 Avg items per store gap vs key category players 5

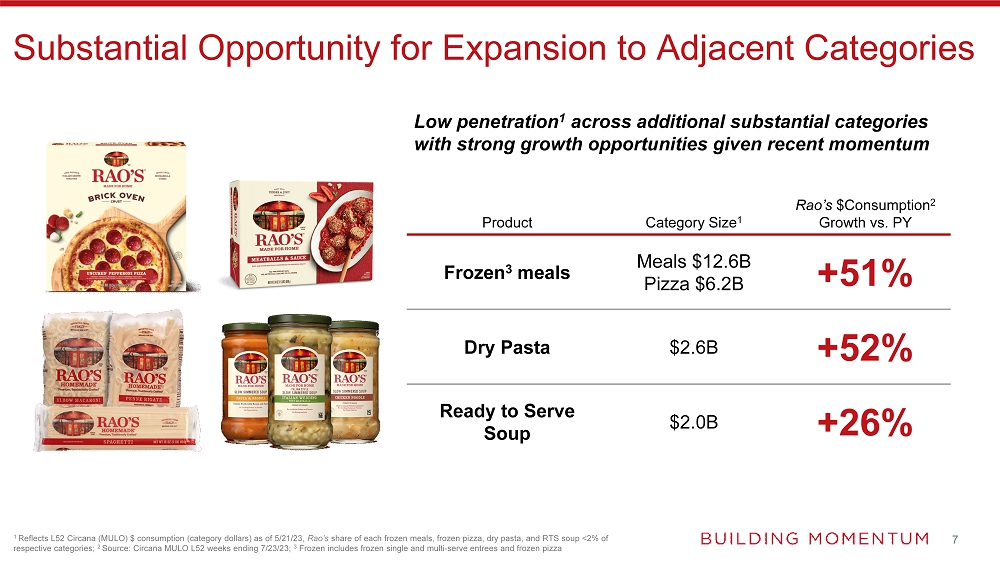

7 Product Category Size 1 Rao’s $Consumption 2 Growth vs. PY Frozen 3 meals Meals $12.6B Pizza $6.2B +51% Dry Pasta $2.6B +52% Ready to Serve Soup $2.0B +26% Substantial Opportunity for Expansion to Adjacent Categories 1 Reflects L52 Circana ( MULO ) $ consumption (category dollars) as of 5/21/23, Rao’s share of each frozen meals, frozen pizza, dry pasta, and RTS soup

8 Michael Angelo’s Adds Authentic Italian Frozen Meals and Additional Supply Chain Scale • Established frozen business with the #1 most preferred Italian frozen entree brand among families 1 • +3% $ Consumption CY 2019 - 22 CAGR 2 • High quality Italian aligned with at home eating trends focused on convenience • Potential for further cost synergy opportunities as the business scales within our Supply Chain 1 Third - party A&U Study from January 2021 ; 2 Circana MULO CY2022 and comparable CY2019 $ consumption as of reporting w/e 7/23/23

9 Great Tasting Products and a Track Record of Strong Performance Provides Optionality • 5% $ Consumption CY 2019 - 22 CAGR 1 with strong, sustainable profitability • Strong leadership in place to operate as an attractive, easily separatable business while Campbell’s evaluates strategic options • High - quality ingredients sourced from local Colorado farms • One of the highest Net Promoter Scores in the yogurt category 2 •

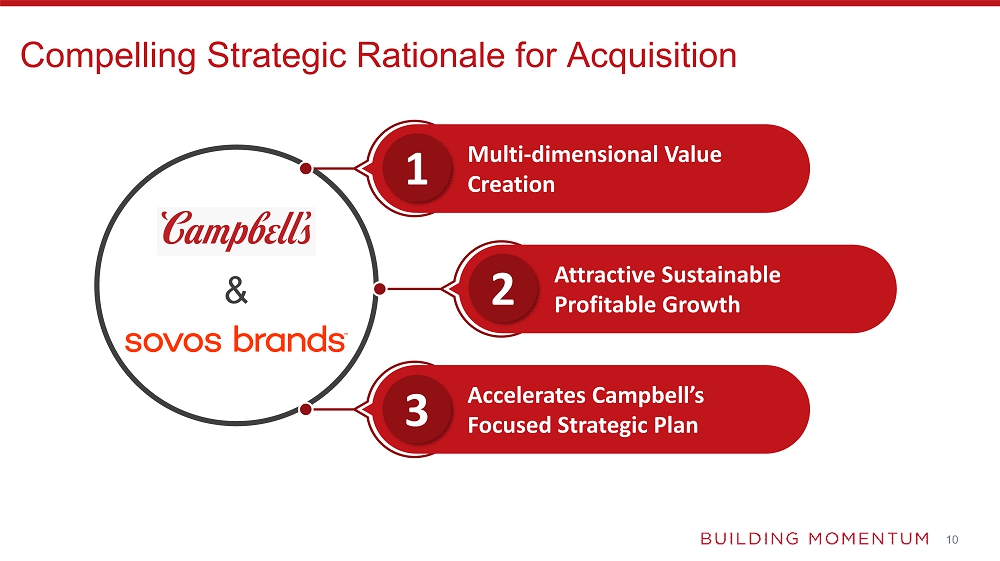

10 Compelling Strategic Rationale for Acquisition Attractive Sustainable Profitable Growth Accelerates Campbell’s Focused Strategic Plan Multi - dimensional Value Creation & 1 2 3

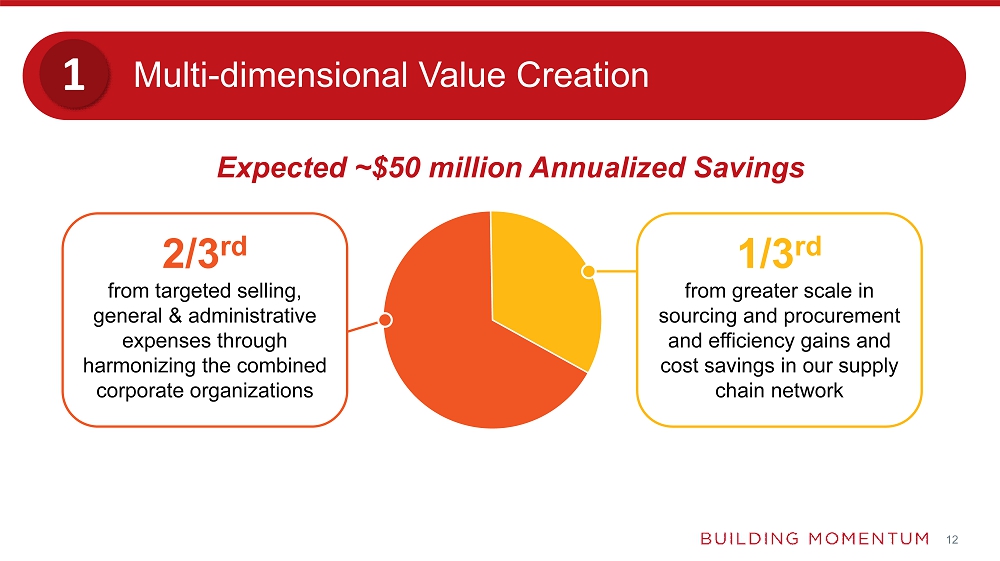

11 Multi - dimensional Value Creation 1 • U nlocks significant value through strong and sustainable growth opportunities • Expect fast, effective and efficient integration and synergy unlock given familiarity with categories and Campbell’s strong capabilities, processes and proven integration playbook • Provides substantial earnings growth contribution to the division while unlocking additional value through meaningful cost synergies • Drives operating synergies while improving scale efficiency of our core operations by leveraging Campbell’s supply chain excellence and scale

12 Expected ~$50 million Annualized Savings 2/3 rd from targeted selling, general & administrative expenses through harmonizing the combined corporate organizations 1/3 rd from greater scale in sourcing and procurement and efficiency gains and cost savings in our supply chain network Multi - dimensional Value Creation 1

13 Attractive Sustainable, Profitable Growth 2 • Significant whitespace opportunity for Rao’s and Michael Angelo’s to reach best - in - class distribution, growing items per store and increasing household penetration • Campbell's expertise in retail execution will enhance shelf productivity, geographic footprint, and sub - category penetration • Enhances and strengthens Campbell’s capabilities with Sovos ’ expertise in innovation, category expansion and the marketing of premium, high - growth brands

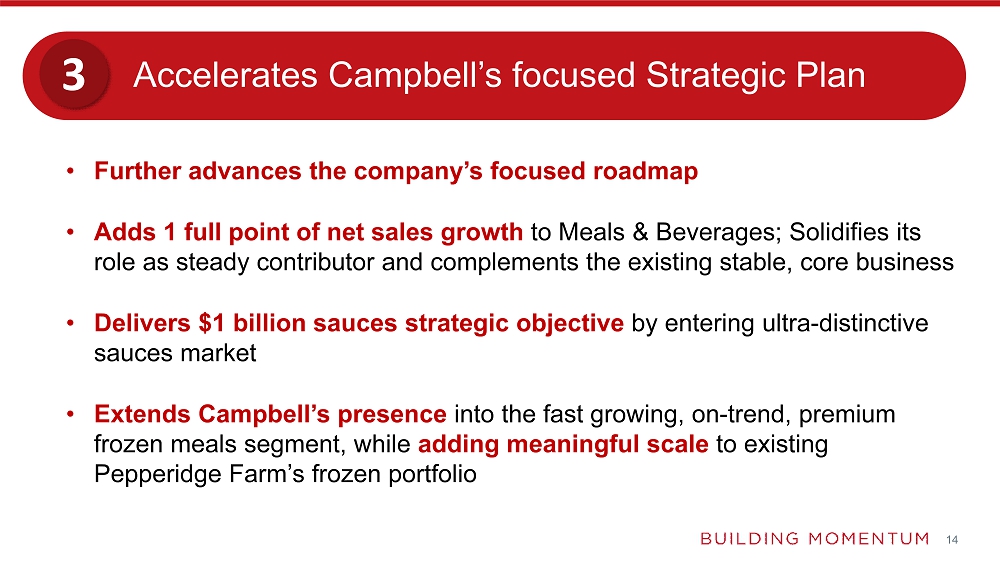

14 Accelerates Campbell’s focused Strategic Plan 3 • Further advances the company’s focused roadmap • Adds 1 full point of net sales growth to Meals & Beverages; Solidifies its role as steady contributor and complements the existing stable , core business • Delivers $1 billion sauces strategic objective by entering ultra - distinctive sauces market • Extends Campbell’s presence into the fast growing, on - trend, premium frozen meals segment, while adding meaningful scale to existing Pepperidge Farm’s frozen portfolio

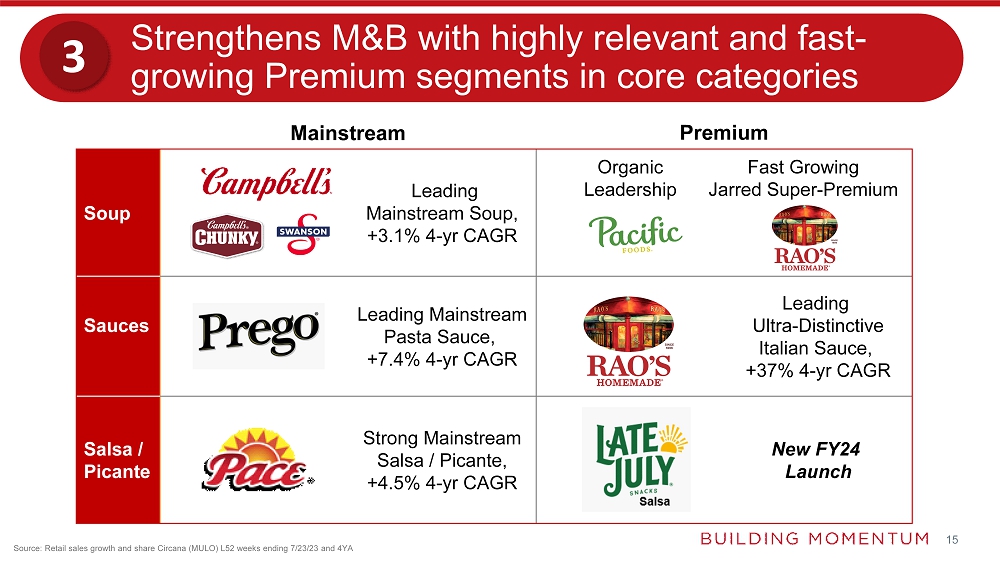

15 Mainstream Premium Soup Leading Mainstream Soup, +3.1% 4 - yr CAGR Sauces Leading Mainstream Pasta Sauce, +7.4% 4 - yr CAGR Leading Ultra - Distinctive Italian Sauce, +37% 4 - yr CAGR Salsa / Picante Strong Mainstream Salsa / Picante, +4.5% 4 - yr CAGR New FY24 Launch Source: Retail sales growth and share Circana ( MULO ) L52 weeks ending 7/23/23 and 4YA Strengthens M&B with highly relevant and fast - growing Premium segments in core categories 3 Organic Leadership Fast Growing Jarred Super - Premium

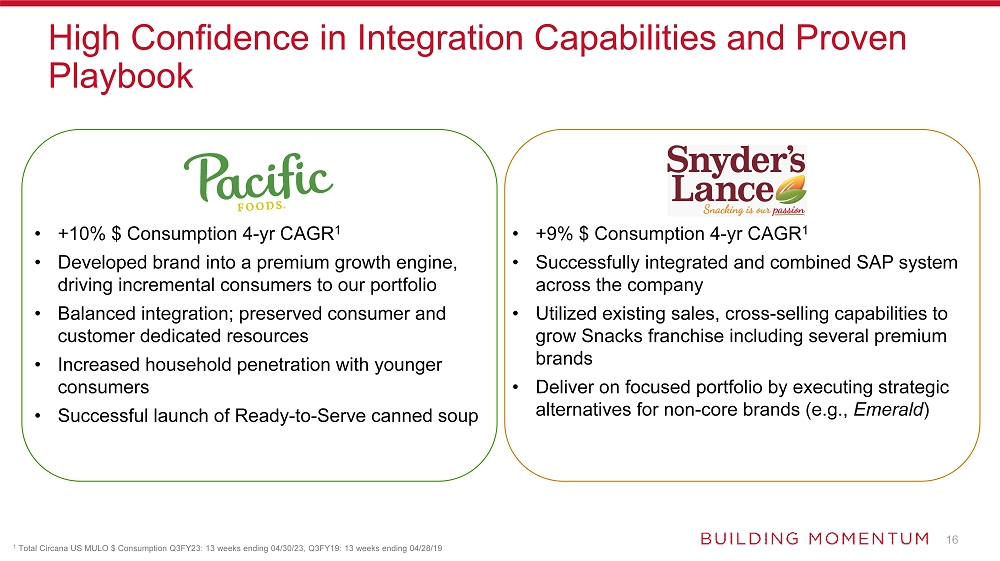

16 High Confidence in Integration Capabilities and Proven Playbook • +10% $ Consumption 4 - yr CAGR 1 • Developed brand into a premium growth engine, driving incremental consumers to our portfolio • Balanced integration; preserved consumer and customer dedicated resources • Increased household penetration with younger consumers • Successful launch of Ready - to - Serve canned soup • +9% $ Consumption 4 - yr CAGR 1 • Successfully integrated and combined SAP system across the company • Utilized existing sales, cross - selling capabilities to grow Snacks franchise including several premium brands • Deliver on focused portfolio by executing strategic alternatives for non - core brands (e.g., Emerald ) 1 Total Circana US MULO $ Consumption Q3FY23: 13 weeks ending 04/30/23, Q3FY19: 13 weeks ending 04/28/19

17 Todd Lachman Founder, President and Chief Executive Officer

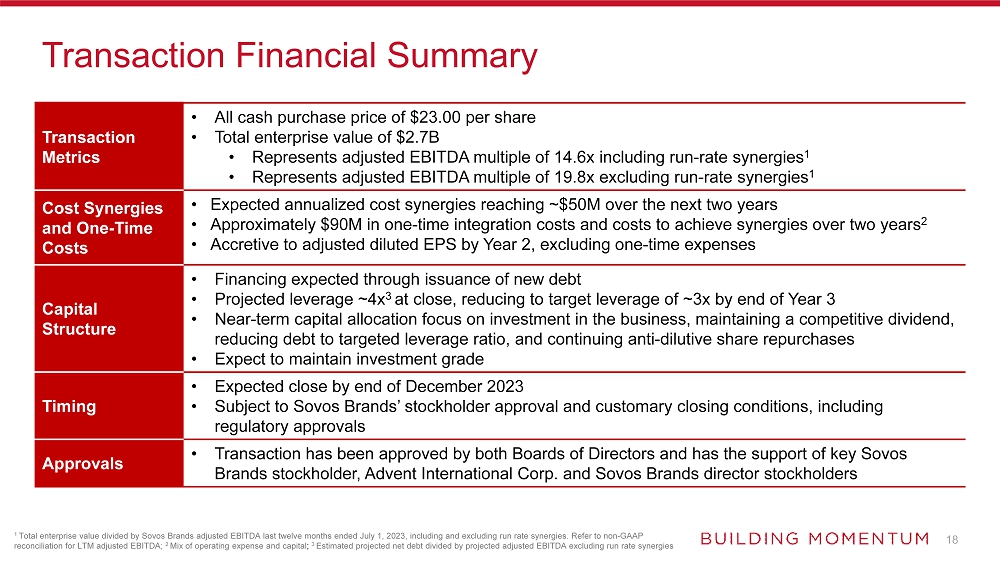

18 Transaction Financial Summary Transaction Metrics • All cash purchase price of $23.00 per share • Total enterprise value of $2.7B • Represents adjusted EBITDA multiple of 14.6x including run - rate synergies 1 • Represents adjusted EBITDA multiple of 19.8x excluding run - rate synergies 1 Cost Synergies and One - Time Costs • Expected annualized cost synergies reaching ~$50M over the next two years • Approximately $90M in one - time integration costs and costs to achieve synergies over two years 2 • Accretive to adjusted diluted EPS by Year 2, excluding one - time expenses Capital Structure • Financing expected through issuance of new debt • Projected leverage ~4x 3 at close, reducing to target leverage of ~3x by end of Year 3 • Near - term capital allocation focus on investment in the business, maintaining a competitive dividend, reducing debt to targeted leverage ratio, and continuing anti - dilutive share repurchases • Expect to maintain investment grade Timing • Expected close by end of December 2023 • Subject to Sovos Brands’ stockholder approval and customary closing conditions, including regulatory approvals Approvals • Transaction has been approved by both Boards of Directors and has the support of key Sovos Brands stockholder, Advent International Corp. and Sovos Brands director stockholders 1 Total enterprise value divided by Sovos Brands adjusted EBITDA last twelve months ended July 1, 2023, including and excluding ru n rate synergies. Refer to non - GAAP reconciliation for LTM adjusted EBITDA; 2 Mix of operating expense and capital ; 3 Estimated projected net debt divided by projected adjusted EBITDA excluding run rate synergies

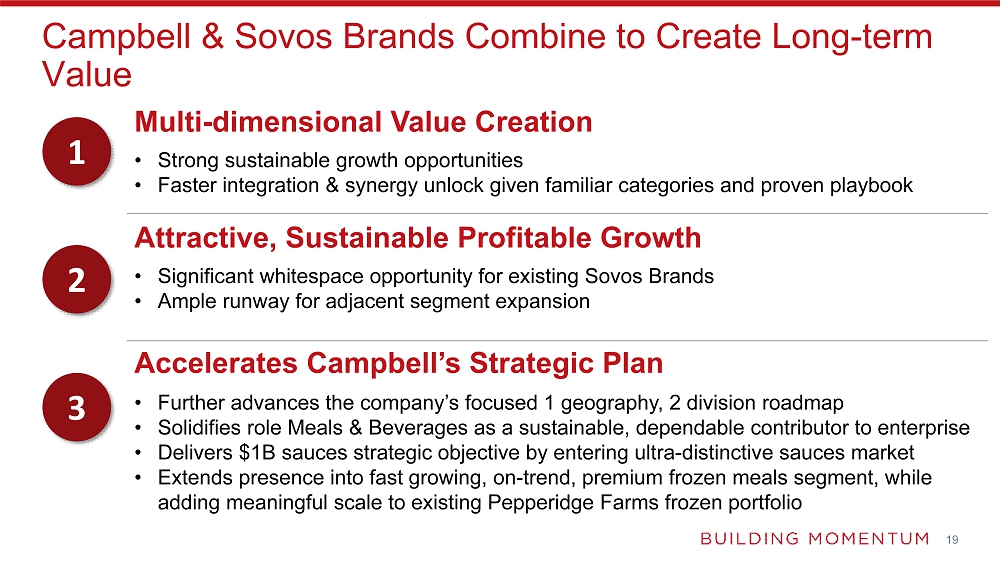

19 Multi - dimensional Value Creation • Strong sustainable growth opportunities • Faster integration & synergy unlock given familiar categories and proven playbook Attractive, Sustainable Profitable Growth • Significant whitespace opportunity for existing Sovos Brands • Ample runway for adjacent segment expansion Accelerates Campbell’s Strategic Plan • Further advances the company’s focused 1 geography, 2 division roadmap • Solidifies role Meals & Beverages as a sustainable, dependable contributor to enterprise • Delivers $1B sauces strategic objective by entering ultra - distinctive sauces market • Extends presence into fast growing, on - trend, premium frozen meals segment, while adding meaningful scale to existing Pepperidge Farms frozen portfolio Campbell & Sovos Brands Combine to Create Long - term Value 2 1 3

20 Questions & Answers Carrie Anderson EVP & Chief Financial Officer Mark Clouse President & Chief Executive Officer Mick Beekhuizen EVP & President, Meals & Beverages Division

21 Appendix

22 Non - GAAP Financial Measures This presentation includes measures that are not prepared in accordance with U . S . generally accepted accounting principles (“GAAP”) . Campbell uses Sovos Brands Adjusted EBITDA and organic net sales, which are non - GAAP measures, in this presentation . For each of these non - GAAP financial measures, we have included below a reconciliation of the differences between the non - GAAP measure and the most comparable GAAP measure . These non - GAAP measures should be viewed in addition to, and not in lieu of, the comparable GAAP measure . Campbell discusses projected leverage in this presentation only in relation to management’s expectations of the future effect of the Sovos Brands transaction and has not provided a reconciliation of these forward - looking projected leverage expectations to the mostly directly comparable GAAP measure due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation, including adjustments that could be made for actuarial gains or losses on pension and postretirement plans because these impacts are dependent on future changes in market conditions, transaction and integration costs and other charges reflected in Campbell’s reconciliations of historical numbers, the amounts of which, based on historical experience, could be significant .

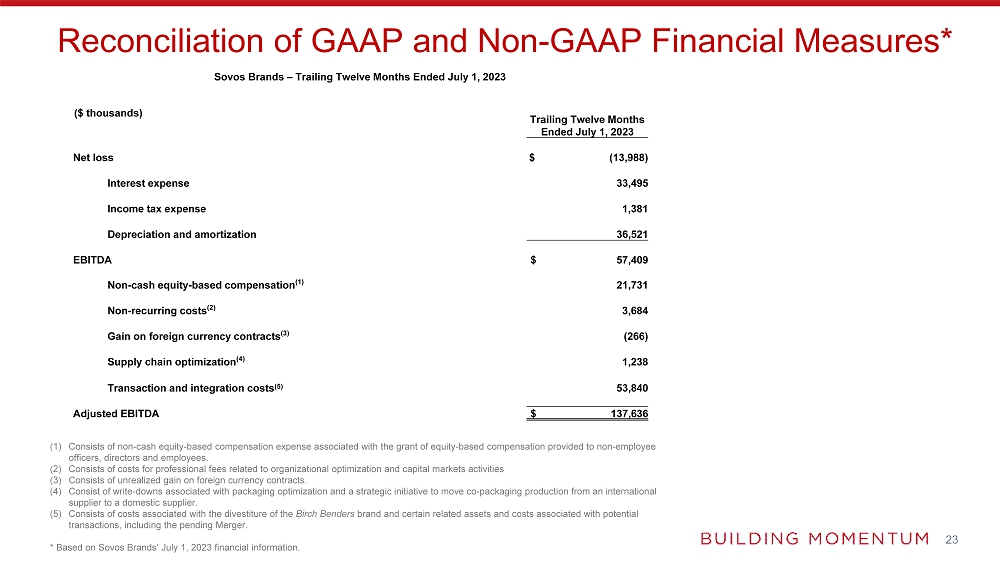

23 Reconciliation of GAAP and Non - GAAP Financial Measures* (1) Consists of non - cash equity - based compensation expense associated with the grant of equity - based compensation provided to non - em ployee officers, directors and employees. (2) Consists of costs for professional fees related to organizational optimization and capital markets activities (3) Consists of unrealized gain on foreign currency contracts. (4) Consist of write - downs associated with packaging optimization and a strategic initiative to move co - packaging production from an international supplier to a domestic supplier. (5) Consists of costs associated with the divestiture of the Birch Benders brand and certain related assets and costs associated with potential transactions, including the pending Merger. * Based on Sovos Brands’ July 1, 2023 financial information. ($ thousands) Trailing Twelve Months Ended July 1, 2023 Net loss $ (13,988) Interest expense 33,495 Income tax expense 1,381 Depreciation and amortization 36,521 EBITDA $ 57,409 Non - cash equity - based compensation (1) 21,731 Non - recurring costs (2) 3,684 Gain on foreign currency contracts (3) (266) Supply chain optimization (4) 1,238 Transaction and integration costs (5) 53,840 Adjusted EBITDA $ 137,636 Sovos Brands – Trailing Twelve Months Ended July 1, 2023

24 Reconciliation of GAAP and Non - GAAP Financial Measures* (1) Reflects Net Sales for the Birch Benders brand generated in the 53 weeks ended December 31, 2022. (2) Reflects Net Sales generated in the 53 rd week by the Rao’s , Michael Angelo’s and noosa brands. (3) Sovos Brands Organic Net Sales and Organic Net Sales growth are defined as Reported Net Sales or Reported Net Sales growth excludin g, when they occur, the impact of a 53 rd week of shipments, acquisitions and divestitures. * Based on Sovos Brands’ July 1, 2023 financial information. ($ millions) Fiscal Year Ended December 31, 2022 December 28, 2019 Reported Net Sales $ 878.4 $ 388.0 Divestiture (1) (41.2) - Adjusted Net Sales $ 837.2 $ 388.0 53 rd Week (2) (18.3) - Organic Net Sales (3) $ 818.9 $ 388.0 3 - Year Compounded Annual Organic Net Sales Growth Rate (3) 28% Sovos Brands - Reconciliation of Reported Net Sales to Adjusted Net Sales and Organic Net Sales: 2019 & 2022

25 Reconciliation of GAAP and Non - GAAP Financial Measures* ($ thousands) 13 weeks ended July 1, 2023 June 25, 2022 Reported Net Sales $ 217,635 $ 197,433 Divestiture (1) — (10,347) Organic Net Sales (2) $ 217,635 $ 187,086 Organic Net Sales Growth (2) 16% Sovos Brands - Reconciliation of Reported Net Sales to Organic Net Sales: Q2 2022 & Q2 2023 (1) Reflects Net Sale s for the Birch Benders brand generated in the 13 weeks ended June 25, 2022. (2) Sovos Brands Organic Net sales and Organic Net Sales growth are defined as Reported Net Sales or Reported Net Sales growth excludin g, when they occur, the impact of a 53 rd week of shipments, acquisitions and divestitures. For discussions of fiscal 2023 results, Organic Net Sales growth excludes the impact of the Birch Benders divestiture and the 53 rd week in the prior year. * Based on Sovos Brands’ July 1, 2023 financial information.