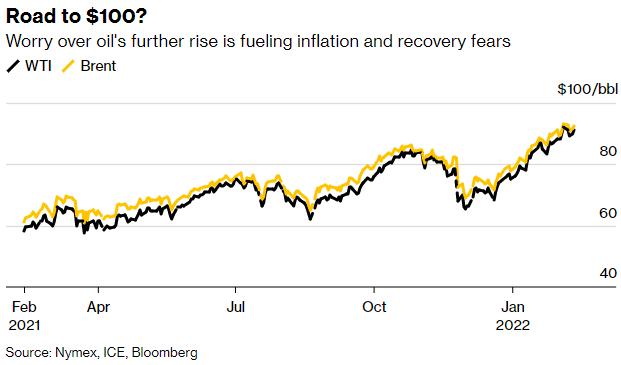

Is an oil supercycle in full swing?

On Monday, oil prices hit their highest level in more than seven years due to fears that a possible invasion of Ukraine by Russia could trigger U.S. and European sanctions that would disrupt exports from the world's top producer in an already tight market.

According to Bloomberg Economics' hok model, a climb in crude to $100 by the end of this month from around $70 at the end of 2021 would lift inflation by about half a percentage point in the U.S. and Europe in the second half of the year.

"We note signs of strain across the group: seven members of OPEC-10 failed to meet quota increases in the month, with the largest shortfall exhibited by Iraq," JP Morgan analysts said in a Feb. 11 note.

![]() The bank said that a super cycle is in full swing with oil prices likely to overshoot to $125 a barrel on widening spare capacity risk premium.

The bank said that a super cycle is in full swing with oil prices likely to overshoot to $125 a barrel on widening spare capacity risk premium.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

wiggieloko : $Rongsheng Petro Chemical (002493.SZ)$ 455554554544567

Molly wealth talkOP wiggieloko: Aha~Do you like the stock?