It is quite normal for stocks to be delisted in the American market.

For the stock market, whether to establish a sound listing and delisting mechanism is one of the important signs to judge whether the market is mature or not. A perfect delisting mechanism helps to ensure the overall quality of listed companies and give full play to the function of survival of the fittest in the stock market.

But in fact, delisting in the US stock market does not mean bankruptcy, nor does it mean that stocks are completely out of circulation.

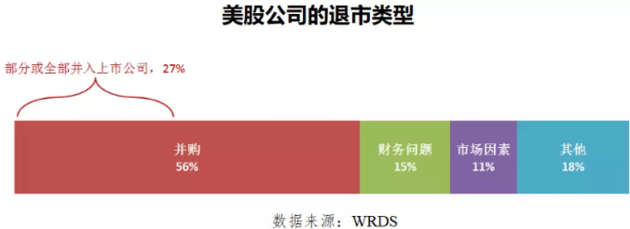

Generally speaking, there are two situations in which stocks are delisted:

1、Be acquired

2、Privatization and delisting forced delisting by the exchange。

What happens if your stock is delisted through mergers and acquisitions or privatisation?

Generally speaking, when a company is privatized and delisted, the controlling shareholder will issue an announcement to buy back all the outstanding shares in the market at a specific price within a specific period of time, so that the listed company will be delisted from the exchange and become a private company.

Privatised takeovers are usually bought at a premium, and the price is usually about 10% higher than the market price of the stock.

So what does privatisation and delisting mean for shareholders?

Take the common tender offer in the US stock market as an example, if the company you hold is about to be offered, you accept the offer, that is, you agree to sell your current position at the offer price.

If you accept a cash offer, you will receive cash after the acquisition is completed and will no longer be a shareholder of the acquired company or the acquired company. If you accept a stock exchange offer, you will receive shares or newly issued shares of the acquirer's company after the acquisition, and represent you as a shareholder of the acquired company or a shareholder of the merged new company.

Note that if you are an individual investor, missing or rejecting an offer may mean that your stock is becoming less liquid, because there are fewer and fewer shares in the company on the market, and when the stock is no longer traded on the exchange, it may be difficult for you to cash out your position.

Although the offer price offered by privatization is usually at a premium to the market price of the stock, this does not necessarily mean that investors will make a profit by accepting the offer. this is because some investors invest much more in the initial cost of buying positions than the income generated by the offer.

Second, what about companies that have been forced to delist (such as LUCKN COFFEE DRC)?

Shares of companies delisted from major exchanges can still be traded on the over-the-counter system (OTCBB) or the pink sheet market (Pink Sheets).

Both OTCBB and pink market are quotation service systems, and the barriers to entry and supervision are much lower than those of the main board markets such as the New York Stock Exchange and NASDAQ. In OTCBB trading, there is no need to complete financial information reporting or to meet the stock price requirements, but it is necessary to register and submit valid documents with the Securities Regulatory Commission, while trading in the pink market does not even need to be registered with the Securities Regulatory Commission, as long as at least one market maker is willing to quote for it. Due to the low transparency and the lack of complete information disclosure, the securities circulating in these two markets are risky and speculative, and the financing function of these two markets is poor for enterprises because of the small number of participants and small trading volume.

If the company cannot survive in the over-the-counter market and eventually go bankrupt, investors' assets may go down the drain; but if the company can reorganize and meet the standard of listing on the exchange after the compulsory delisting, it is expected to be re-listed, so that the shares held by shareholders can also re-enter the exchange.

In the first case, you will usually be given a repurchase price.Often higher than the original stock price.。

If this is the second case,Investors may want to pay more attention to the related risks.。

III. Delisting standards vary from market to market in the United States.

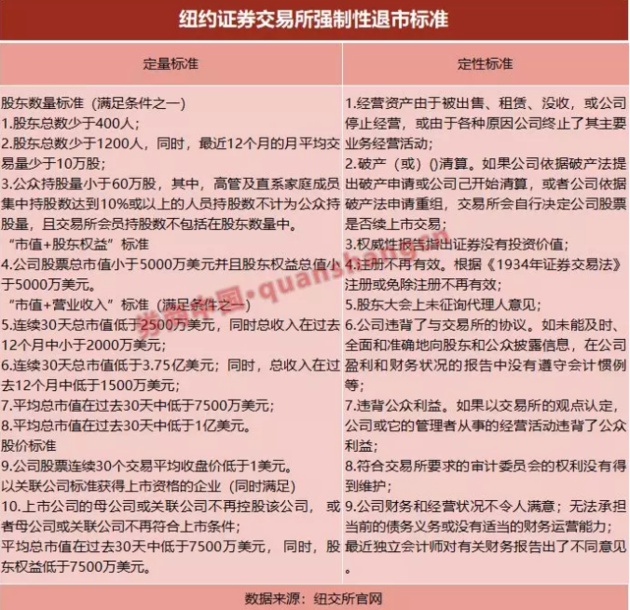

1. New York Stock Exchange

The delisting standard of the New York Stock Exchange has few provisions in terms of voluntary delisting, mainly focusing on compulsory delisting. The criteria for compulsory delisting can be divided into three categories: transaction indicators, sustainable operating capacity indicators and compliance indicators. Specifically refers to:

One is whether there is active trading, which requires that the stock trading of listed companies must meet certain liquidity standards, including the number of shareholders, public shareholding, trading volume, market value, stock price and so on.

The second is whether it has the ability of sustainable operation, which requires listed companies to have the ability of sustainable operation. The indicators mainly include whether the main activities are stopped, whether there is bankruptcy liquidation, unable to repay debts, lack of financial operation ability and so on.

Third, whether to meet the compliance requirements, such indicators require listed companies to comply with the requirements of corporate governance, information disclosure and so on. the indicators mainly include whether the annual report is not disclosed on time, whether it violates the listing agreement, whether it violates the public interest, whether an audit committee is convened, whether it is issued a non-standard audit opinion, and so on.

2. NASDAQ

Nasdaq Stock Market is the largest listing place of Nasdaq in the United States, with three market segments: global selected Market (NASDAQ GS), Global Market (NASDAQ GM) and Capital Market (NASDAQ CM). The global selected market has the highest listing standard, which mainly attracts the listing resources of large and high-quality enterprises; the global market belongs to the middle level, mainly serving medium-sized enterprises; the capital market is the earliest market level established at the early stage of the establishment of NASDAQ, and the listing standard is the lowest, mainly serving small and micro enterprises.

According to the characteristics of different markets, NASDAQ has formulated different standards for continuous listing:

First, trading indicators, including the number of shares held by the public, the market value of shares, the number of market makers, and so on.

Second, continuing operation indicators, including income, asset scale, shareholders' rights and interests, etc.

Third, compliance indicators, including information disclosure, independent directors, audit committee and other requirements.

Among them, the first two categories are quantitative indicators, and the latter are qualitative indicators, which are mainly regulated from the internal governance of the company. Delisting is triggered when the listed company does not meet the conditions for continuous listing. However, NASDAQ in the implementation of the delisting system is not immutable, in 2001, 2008 and other market slump, NASDAQ suspended the implementation of the minimum market value and minimum quotation indicators.

From past experience, the delisting process of the company is relatively smooth. On the one hand, the NYSE effectively communicates with the market through press releases and websites, so that investors will not be misled by unofficial news. On the other hand, investors in the US market are mainly institutions, and their investment concepts are more mature. They can rationally see that the valuations of companies that touch delisting risks usually continue to decline, and there is not much market speculation. Under the influence of these two factors, the market is easy to accept that the company is forced to delist, the motivation of the stakeholders to resist delisting is small, and the delisting mechanism runs relatively smoothly.

Edit / isaac