The Fed is scheduled to hold a monetary policy meeting from November 2 to 3. In view of the hawkish positions of several developed country central banks, the market paid special attention to the Fed's interest rate meeting.

Peter Tchir, an analyst at Academy Securities, said that in previous meetings, the Fed had been too formal to meet the "benchmark" predicted by the agency. But this Fed meeting is very different and has the potential to cause market volatility.

Why is the Fed's monetary policy different from the usual?

Peter Tchir said that first of all, the background of this meeting is very different. At present, market expectations are more radical than the most hawkish camp in the Fed's bitmap. The market's rate-raising pricing based on Fed fund futures has surpassed the craziest hawkish view of 2022. So what will happen at this Fed meeting? Will the hawkish camp cater to market expectations and become more hawkish, or will it do nothing and magnify the "expectation gap" between the market and the Fed? This is a point of great concern.

Central banks in other developed countries have begun to raise interest rates or reduce bond purchases. On September 22nd the Fed stood still, but the Norwegian central bank raised interest rates the next day. Since then, hawkish positions have been shown and even hawkish actions have been taken from Australia to Canada, from the Bank of England to the European Central Bank.

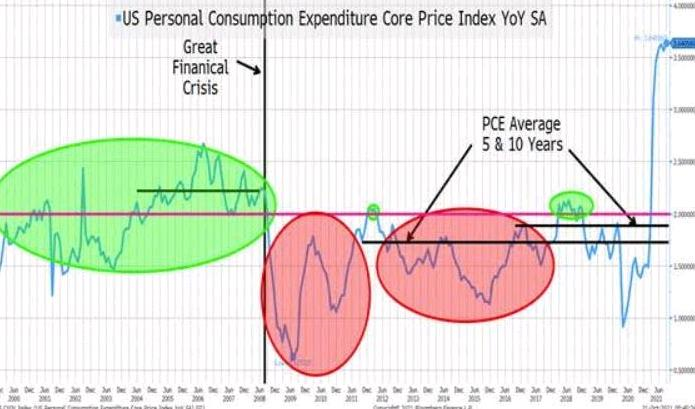

Second, the view that high inflation is temporary is being abandoned by the "private". Wall Street institutions and the business community believe that high inflation may last much longer than the Fed expected. A large part of the high inflation is due to outbreaks and natural disasters, which have had a big impact on the global supply chain. Judging from the current situation, the improvement of the global supply chain has a long way to go.

Third, the actions of the central banks of Canada and Australia have caused volatility in the bond market. Although the volatility of the bond market is independent of the global stock market some time ago, whether this "independent market" will be broken by the Fed's monetary policy meeting has become one of the issues of greatest concern to the market.

What's new in this Fed meeting?

In September, Powell successfully communicated to the market the standard difference between Taper and interest rate hikes, which are separate and not closely related.

Peter Tchir thinks the Fed will announce Taper this time. It has been more than a year since the Fed QE, and it is time to announce the withdrawal of liquidity. In anticipation, the market believes that the Fed is gradually reclaiming liquidity, which is also priced. If the Taper announced by the Fed were more aggressive, the market would no doubt take a hit, US bond yields would soar and risky asset prices would fall.

Peter Tchir also stressed that the Fed may not announce Taper, although this will damage the Fed's credibility. But if that happens, risky assets will be the first to rebound, and then virtual currencies such as bitcoin will soar, and as before, the dollar will fall to a new low again.

In terms of inflation, the Fed is not expected to stress that it is "temporary". Although, inflation is temporary, it will give the Fed a good reason to remain dovish. Peter Tchir believes that Powell will remain dovish for this reason.

In terms of employment, the data are still not satisfactory and the necessary conditions for raising interest rates have not been met. At present, the US labour force participation rate is declining and the number of unfilled jobs is still a record. Although the job-boosting effect of low interest rates is difficult to quantify in the current US, the Fed will delay raising interest rates by citing employment data.

Peter Tchir concluded that this will be a challenging meeting for the Fed and Powell.

80% probability scenario: Powell announced a gradual Taper and did his best to allay concerns about raising interest rates. The Treasury yield curve steepens significantly, and as long-term bond yields soar, growth stocks may initially react negatively, but cyclical stocks and small-cap stocks should perform better.

2% probability scenario: raising interest rates is on the agenda. If the Fed confirms a rate hike (and Taper), that could be a little bad. Raising interest rates is far worse for markets and the economy than Taper.

18% probability scenario: Taper will not be announced. Then the stock market is likely to soar, at least initially, and virtual assets will soar as a result.

Edit / Ray