Australian lithium mining company Pilbara held its second spodumene concentrate auction on Sept. 14, and the final auction price showed $2240 / dry ton, which continued to hit an all-time high, far exceeding the current mainstream price of about $1000 / dry ton of lithium concentrate and exceeding market expectations.

As early as July 29th, when only 17 bidders took part in Pilbara's first auction, the final transaction price was as high as $1250 per dry ton, which shocked the market.

The lithium concentrate auctioned for a high price of US $2240 / dry ton. According to Haitong's calculation, considering the sea freight and the reasonable profit of the lithium salt factory, the corresponding lithium salt price will exceed 200000 yuan.

Here I have to introduce Pilbara, which is the main lithium mining company in Australia, which is the major lithium mining base in the world.

Before the two lithium mine auctions that shocked the industry, the news that Pilbara had sparked heated discussion in the domestic media was that in September 2019, the Ningde era bought a stake in Pilbara for A $550 million (current price about 263 million yuan), accounting for 8.5% of the total share capital after the issue at that time, while before the Ningde era, Ganfeng International, a wholly owned subsidiary of Ganfeng Lithium, was the largest shareholder in Pilbara, with a stake of about 8.24%.

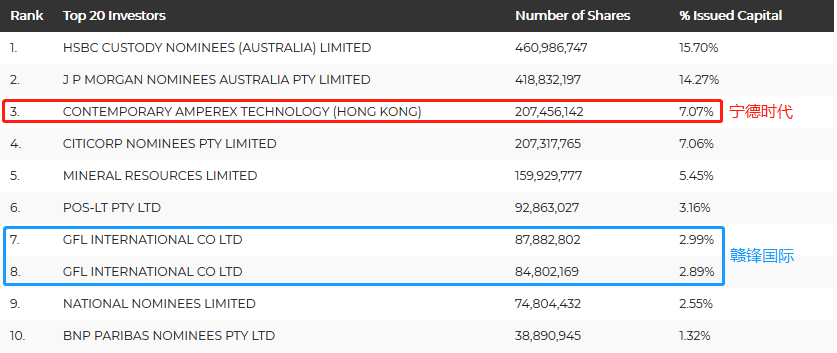

Now, if you look up the shareholders on Pilbara's official website, you will find that the first and second largest shareholders have been occupied by investment institutions. Ningde Times is now its third largest shareholder, with a shareholding ratio of about 7.07%, while Ganfeng Lithium's subsidiary ranks seventh or eighth, with a total shareholding ratio of 5.88%.

Ningde Times also recently made a C $377 million (US $298 million) offer for Vancouver-based Millennial, according to Bloomberg, citing people familiar with the matter. It is also reported that China Molybdenum is also considering bidding for Millennial and may consider a joint bid with Ningde Times.

The battle for lithium ore has been going on for a long time and is becoming more and more intense.

From the perspective of the world as a whole, from Australia, Quebec, the United States to Europe, from Brazil, South America Lithium Triangle to China's Qinghai and Tibet, investment, financing and raw material underwriting in the upstream lithium resources are picking up.

And it is very obvious that the protagonist of this round is not only Chinese capital, but also the middle and lower reaches of automobiles, industrial giants and financial capital. All the characters are speeding up their approach, seeking to lock in scarce upstream high-quality assets.

To understand the whole story of the battle for lithium more clearly, we need to start with the history of families getting rich in lithium mines.

The History of Family Wealth in Lithium Mine

Lithium is a kind of metal element, the element symbol is Li, the corresponding element is silver-white soft metal, and it is also the metal with the lowest density, which is mainly used in atomic reactors, light alloys and batteries.

Lithium and its compounds are not typical like other alkali metals, because lithium has a high charge density and a stable helium double electron layer, which makes it easy to polarize other molecules or ions, but keeps itself stable.

With the continuous development of electronic products such as computers, digital cameras, mobile phones and mobile power tools, the battery industry has become the largest consumer of lithium. With the global green recovery era, "carbon neutralization" has become the target, the production and sales of new energy vehicles have increased rapidly, and the proportion of batteries in the downstream application of lithium has increased by 60%. Lithium ore resources have also risen to an important position of strategic resources in the global resource pattern.

There is "lithium" all over the world, but it is difficult to move without "lithium". It has become a common joke in the investment circle since the beginning of this year.

But this phenomenon did not appear from the beginning. From 2015 to 2016, lithium resources ushered in a bull market.

In the early stage, the downstream of lithium was mainly industrial and medical, and the demand was relatively stable, so there was no large-scale expansion of lithium mining. After 2015, countries, mainly China, began to put forward new energy subsidy support policies. With the rapid growth of demand in the new energy vehicle market, the demand for lithium resources began to blow out.

Triggered by the rise in the price of Greenbushes concentrate in Terrison Australia and the overall 10% increase in lithium salt prices in Hombre Muerto Salt Lake, the predecessor of Livent, lithium carbonate prices soared from only 50,000 yuan / ton in October 2015 to 160000 yuan / ton in April 2016, while lithium hydroxide prices soared as high as 180000 yuan / ton in just six months.

Until the beginning of 2018, the price of lithium resources has been high in the upward range, during this period, the rapid expansion of demand and high prices have driven the development of a large number of lithium mines in Western Australia and North America, and the supply of the market has been expanding.

However, in the subsequent period from 2018 to 2020, lithium carbonate and lithium hydroxide were in a downward price range.

Due to the influence of the transmission mechanism, a number of upstream lithium mines have operational difficulties in 2020, including the most recent tuyere Pilbara.In June 2020, analysts quoted materials as follows:

MRL/ALB 's Wodgina mine, which has 260 million tons of raw ore reserves and a total lithium concentrate production capacity of 750,000 tons per year, announced that it would stop production and maintenance in October 2019. Galaxy Resources's two Mt Cattlin mines plan to cut their 2020 production guidelines by 0%. Pilgangoora, owned by Magi Altura Mining, and Pilgangoora, owned by Pilbara Minerals, ease the financial pressure by raising capital through rights issues.

It was during the downturn of the industry that Ningde era seized the opportunity to buy shares in Pilbara.

At the beginning of 2020, with the impact of the epidemic on production capacity, the current supply of the market is tight, and with the sustained high growth of the global new energy market in 2020, lithium resources are expected to come out of the three-year weak trend and re-enter a new cycle.

The global lithium mineral resources are mainly in Western Australia and South America.

Therefore, the price of lithium ore is not immutable, and it also follows the cycle of supply and demand, and at a time when new energy is already strong, lithium resources have ushered in an obvious upward cycle, so it has naturally become the focus of attention.

From the point of view of the global distribution of lithium resources, lithium ores and salt lakes are the main distribution forms of global lithium resources.As the most important part of the whole industry, the mining of upstream lithium ore resources and the production and processing of basic lithium salt are the foundation of the whole industry. Lithium resources are mainly extracted and processed through two types of rocks (spodumene, lithium mica, lithium feldspar, etc.) and brine (salt lake brine, underground brine, etc.).

Early lithium resources mainly come from the extraction and processing of lithium ores. With the large-scale development and exploitation of salt lakes in South America (mainly Chile) after 2000, brine-type lithium salt resources account for more than 70% of the world's exploitable reserves. At present, it accounts for 45% of the global lithium supply, which has become an important part of lithium resources processing.

Judging from the proportion of global lithium resources, the global lithium resources are mainly concentrated in the "three lakes and seven mines" in South America and Australia.

Salt lakes are easier and cheaper to exploit. The three major salt lakes currently in production: Atacama, Hombre Muerto and Olaroz, and two more are developing salt lakes Caui and Vida, both at the junction of Chile, Argentina and Bolivia in South America, known as the "lithium triangle".

Australia and South America together account for 75% of the world's lithium reserves, of which lithium ore is mainly distributed in Australia, while lithium salt lakes are mainly distributed in South America.

1. Lithium ore resources are mainly located in Western Australia.

Lithium ore resources are mainly distributed in western Australia, the Great Lakes region of North America and southern Africa, of which Australia is the world's largest lithium ore producer. According to Roskill, Australia accounts for more than 50% of the world's lithium ore production.

At present, there are 8 lithium mines built or under construction in Australia, all of which are distributed in Western Australia, and the lithium mines are all pegmatite spodumene, the quality of the ore is good, and the quality of lithium salt products is more stable.

2. Most of the salt lake resources come from South America.

Salt lake resources are mainly distributed in the "Lithium Triangle" of South America, the western part of the United States and the Qinghai-Tibet region of China. South American Salt Lake is the best brine resource in the world, mainly concentrated in the lithium triangle region-Chile, Bolivia and Argentina. Together, these three countries account for more than 50% of the world's total lithium reserves, and 58% of the world's total lithium resources. The representative salt lakes in the "lithium triangle" in Central and South America are Salar deAtacama salt lakes developed by SQM and Yabao, the representative salt lakes in the western part of the United States are Lithium-X and Clayton Valley salt lakes developed by Yabao, and the representative salt lakes in Qinghai and Tibet in China are East Taijinel Lake, Chaerhan Salt Lake and so on.

The ratio of magnesium to lithium in South American salt lake is low, usually less than 8, the concentration of lithium ion in salt lake is high, the resource endowment is good, and the cost of extracting lithium from salt lake is low, which is the lowest production cost of lithium carbonate in the world.

Why are all competing for lithium ore resources?

From a global perspective, the United States, China and Europe have all put forward long-term carbon neutralization targets this year, as well as further guidelines on the permeability of new energy vehicles:

1) China will achieve 20% penetration of new energy vehicles in 2025. The State Council proposes that the penetration rate of new energy vehicles in China will reach 20% in 2025.

2) Europe will achieve 100% penetration of new energy vehicles in 2035. The European Commission proposes that net greenhouse gas emissions in the EU will be reduced by 55% in 2030 compared with 1990, and that new energy vehicles will be fully electrified in 2035.

3) the United States will achieve 50% penetration of new energy vehicles by 2030. The Biden government proposed a 50% reduction in greenhouse gas emissions compared with 2005, and the penetration rate of new energy vehicles reached 50%. Governments of all countries have given strong carbon emissions and new energy vehicle penetration guidelines from the top-level design point of view, and the demand for new energy vehicles will continue to improve under the policy guidance.

The core of the electric vehicle is the battery, and lithium is the core metal element that makes up the power battery, whether it is ternary lithium battery, lithium iron phosphate battery, or the solid-state battery that represents the future.

Each electric car needs about 9kg lithium.For the new world of electric cars replacing fuel vehicles, whoever controls the lithium resource supply chain will control the future of power batteries.

In terms of status, the European Union lists lithium as one of the 14 key raw materials, the United States regards lithium as one of 43 important mineral resources, and China positions lithium as one of 24 national strategic mineral resources.

Imagine the status of "oil" when fuel vehicles were the main force in the past few decades, and you can probably understand the importance of "lithium" resources in the new energy context.

Due to the above-mentioned reasons, due to the downward price of lithium, many major mines suffered operating pressure last year, either reducing production or suspending production, resulting in restrictions on the supply of global lithium resources.

The "Seven Lithium Mining era" basically ended last year.At present, there are 5 lithium mines active in production and sales in Western Australia.

Therefore, it is difficult to achieve a breakthrough in terms of supply in the short term.

Some people may say, what about the new mines?

Last year, Tesla, Inc. planned to build a battery factory in his new plant in Berlin, which is expected to have an annual capacity of up to 250GWh, equivalent to half of global battery capacity this year.

But it is easy to build a factory, but difficult to build a mine.Bloomberg has predicted that there could be a shortage in the lithium hydroxide market by 2027. AndIt will take about five years for the new factory to come online.

Five years has been too long for the demand of the new energy industry.

The whole lithium resources industry is in a state of imbalance between supply and demand on the right side of the bottom, which is the most important reason why the price of lithium ore has reached a new high, and it is also one of the reasons why companies from all over the world are competing for lithium resources.

In the final analysis, the basic logic is that whoever controls the mineral resources will control the cost. At the same time, the current situation is: supply can not keep up, demand can not afford to wait.

How to deal with it at home?

From a domestic point of view, the difference between supply and demand is also huge.

China is in short supply of lithium, and 70% of it has to be imported.

But on the demand side, China ranks first in the world.

According to Roskill statistics, China accounted for 54% of global lithium consumption in 2019, while South Korea and Japan ranked in the top three, accounting for 20% and 12%, respectively. China is the largest production and marketing base of new energy vehicles and power batteries in the world. the development of new energy vehicles has led to a sharp increase in the demand for upstream lithium salt.

1. Go out

As a big demand countryFrom a commercial point of view, from the point of view of controlling costs and unrestricted production, it is of course very important for Chinese enterprises to go out and seize the right to say the cost of lithium mines, which is exactly what Ningde era, Tianqi Lithium Industry and Ganfeng Lithium are trying to do.

In addition to the actions of the Ningde era and Ganfeng Lithium, Tianqi Lithium, currently the world's third-largest producer, holds a 51% stake in Terlison Lithium Co., Ltd., which owns Greenbush, the world's largest spodumene mine, and once supplied 65% of the world's lithium ore.

On the other hand, the other aspect of cost control is to take the initiative to develop their own existing resources.

2. Strategically improve the status of lithium extraction from salt lakes?

Australian lithium concentrate adopts the mode of competitive auction, which makes it more difficult for Chinese lithium salt enterprises to cooperate with it, and makes the cost management of lithium out of control.

Although some analysts have proposed that future auction sales and underwriting will go hand in hand, the amount of scattered lithium minerals that can enter the market auction is very small, but this will still put pressure on the entire market price.

In terms of price, the cost of spodumene development is 1.4 times higher than that of lithium in salt lakes. China, the world's largest consumer of lithium, has imported more than 90% of lithium from Australia in recent years.Therefore, judging from the current situation, the downstream has a poor ability to resist the risk of market price fluctuations. Once the price of lithium resources fluctuates, it will directly affect the operation of relevant enterprises' investment projects in lithium mines in Australia, and then affect the supply of lithium resources in the new energy industry.

Societe Generale Securities analysts believe that the height of lithium extraction from the salt lake should be strategically raised.

At a time when the difficulty and risk of overseas investment is increasing, and the importance of local lithium resources is unprecedented, it is also very important to make good use of one's original endowment to strengthen development.China's salt lake lithium resources account for about 12% of the world's lithium resources.

Judging from the reserve form of lithium resources in ChinaThe total amount of lithium in salt lake is much higher than that of spodumene and lithium mica, in which salt lake resources are mainly concentrated in Qinghai, Tibet and Hubei, while spodumene is mainly in Sichuan.

On the demand side, among the two technical routes of power batteryLithium hydroxide is mainly used in high nickel ternary batteries.Mainly mined by lithium mines; andLithium carbonate is mainly used in lithium iron phosphate battery.It is mainly mined by salt lakes.

Among them, lithium iron phosphate battery is the best choice for low-price electric vehicles because of its low cost, so its shipments are also the largest, such as the lithium iron phosphate battery used in the domestic version of Tesla, Inc. Model3.

By 2021, China's salt lake production capacity totaled about 120000 tons of LCE (11.5 tons in Qinghai + 0.5 in Tibet), and analysts believe that it is expected to exceed 200000 tons of LCE in the future.

In the case of one side going out to get resources, the other side takes the initiative to develop its own existing resources and realize the autonomy of lithium resources at various levels, which may be a necessary choice for relevant enterprises to face the battle for lithium mines.

Edit / Anita