Source: Wall Street

Author: Zhou Xinyu

Niuniu knocks on the blackboard: as the economy and inflation enter the fluctuation range, on the one hand, it means the arrival of the marginal inflection point of liquidity, on the other hand, it also means that the upward range of corporate profits has narrowed. The intensification of price volatility of risky assets is inevitable. At the same time, July and August are also the time for the release of the semi-annual report, and the correlation between profitability and asset price performance will be strengthened.

Niuniu knocks on the blackboard: as the economy and inflation enter the fluctuation range, on the one hand, it means the arrival of the marginal inflection point of liquidity, on the other hand, it also means that the upward range of corporate profits has narrowed. The intensification of price volatility of risky assets is inevitable. At the same time, July and August are also the time for the release of the semi-annual report, and the correlation between profitability and asset price performance will be strengthened.

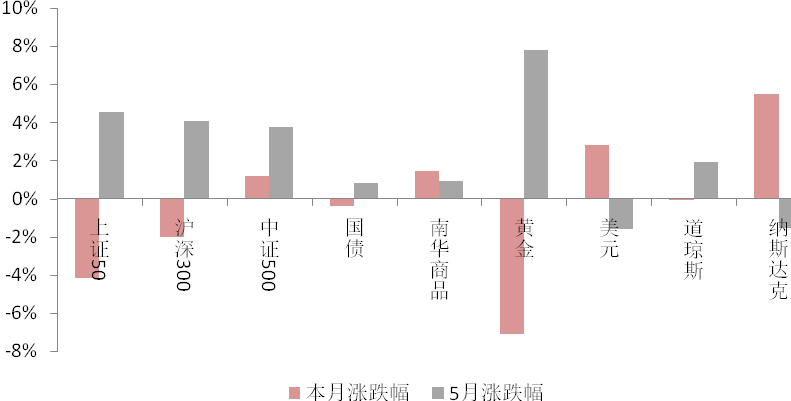

6Monthly Review of large categories of assets: the Federal Reserve turns to the "Eagle" and the Central Bank expands its statement

In June, there were two things that had a great impact on the asset market. first, the tone of the Fed's interest rate meeting was too "hawk". This has reduced the risk appetite of global funds. The dollar rose, the stock market fell, and commodities pulled back. Second, the domestic market was boosted by the unexpected expansion of the central bank's table and reverse repurchase in the second half of the year. The scope of domestic inter-bank funds is still wide, even if the lending rate rebounded in the new year, but not more than the seasonal level.

In addition, the expression of "maintaining stability" has increased in the central bank's second-quarter monetary policy report this week. Including the domestic research and judgment description from "increasing, positive factors significantly increased" to "stable reinforcement, stable and better". International research has decided to delete the statement of "overseas epidemic situation and the improvement of the economy" and add the phrase of "preventing external shocks". The policy tone has added the saying that "maintain the overall stability of the economy and enhance the resilience of economic development." The future work has changed from the expression of "high-quality development" to "promoting the economy to reach a higher level of equilibrium in recovery".

For 7Month and even the whole third quarter, how to understand the word "steady"?

In fact, the market has significant concerns about liquidity after July.

From the perspective of overseas factors, when the US debt ceiling was reset at the end of July, the fiscal account is likely to change from releasing liquidity to recovering liquidity; at the same time, due to the level of inflation and the upward movement of the inflation center, the formal discussion of US QETaper in the third quarter has become a consensus expectation, so the marginal growth rate of liquidity is entering a landmark inflection point.

From the perspective of domestic factors, the main reason is that the arrival of the peak of local government bond issuance will correct the wide liquidity and low capital interest rate in the early stage.

Before the superposition, the signal significance of the central bank's continuous net investment of 20 billion. We believe that "stability" means that the central bank may be more active in hedging some liquidity disadvantages. NamelyThe central bank may be more protective of the upward interest rate (tight) than the fall in repo rates (with a wide range of funds).

7Monthly Asset Outlook: will inflation fall significantly?

As the domestic recovery enters the second half, the performance of inflation may to some extent determine the positioning of the cycle and the composition of large categories of asset allocation. If inflation cools significantly and enters a downward trend, then the allocation will become a safe haven. If not, the performance of risky assets will still be dominant. So has inflation entered a downward trend? Will inflation fall significantly?

I'm afraid not.

From the correlation between the purchase price of PMI and the month-on-month ratio of PPI, the month-on-month pressure of PPI will be alleviated obviously in June. PPI growth is expected to be in the range of-0.1-0.5 per cent month-on-month in June, July and August, but strong year-on-year growth will remain around 8.7 per cent, 8.2 per cent and 8.1 per cent. Even if the momentum of new price increases alleviates significantly in the second half of the year, PPI will have to wait until after November to enter a significant pullback phase.

As the economy and inflation enter the fluctuation range, on the one hand, it means the arrival of the marginal inflection point of liquidity, on the other hand, it also means that the upward range of corporate profits has narrowed. The intensification of price volatility of risky assets is inevitable. At the same time, July and August are also the time for the release of the semi-annual report, and the correlation between profitability and asset price performance will be significantly strengthened.

Commodities: shock upward, strengthening the differentiation between supply and demand

From the perspective of the economic cycle, it is still in the stage of stagflation, and the contradiction between supply and demand cannot be alleviated in the short term.Commodity prices will also be mainly shock upward, gradually entering the process of seeking the top.Varieties still continue the previous view, international bulk varieties can be chemical, copper and aluminum or better than domestic steel, coal, but the current contradiction between power plant inventory and power consumption peak, coal prices still have support. In addition, the downward pressure on gold is hard to abate in July. The Fed's interest rate meeting and employment data in July may cause real interest rates to rise and the dollar to rebound, thus continuing to put pressure on gold prices.

Bonds: the downside of yields needs to be supported by higher-than-expected factors

Bond assets rebounded after falling this month, and the trend, as in the previous period, reflects more of the optimism on the financial side, while the expected decline in the supply of government bonds, rather than from fundamental allocation demand, makes current bond assets insensitive to inflation. At present, the downside of the 10-year Treasury yield is relatively limited.A further downturn requires the support of a worsening economy that exceeds expectations or a fall in inflation that exceeds expectations.. With the increasing uncertainty of liquidity level, bond assets should be dominated by shocks.

Stocks: return to performance support Logic

In June, the Fed's higher-than-expected "hawks" brought the liquidity logic to an early end. The hot spots in the market are focused on small notes, themes and sub-new stock plates, with higher increases in sectors such as electrical equipment, electronics, automobiles, chemicals and so on. In terms of funds, the main increment is on-site funds plus leverage. With the arrival of the semi-annual report window in JulyThe performance, especially the sector where the performance exceeds expectations, may have a higher margin of safety. Among them, the profit growth rate is accelerating month-on-month, which means that some industries are speeding up their repair in the recovery. Including pharmaceutical manufacturing, automobile manufacturing, furniture manufacturing, textile and clothing industry and so on.

Edit / isaac