Source: Tencent US stocks

Niuniu beat the blackboard: Morgan Stanley analyst Wilson wrote in the report that while the Fed "started" to talk about austerity this time, which surprised most people in the market, the reality is that the market has been preparing for the inevitable process several months ago, and the market itself is the best evidence.

Niuniu beat the blackboard: Morgan Stanley analyst Wilson wrote in the report that while the Fed "started" to talk about austerity this time, which surprised most people in the market, the reality is that the market has been preparing for the inevitable process several months ago, and the market itself is the best evidence.

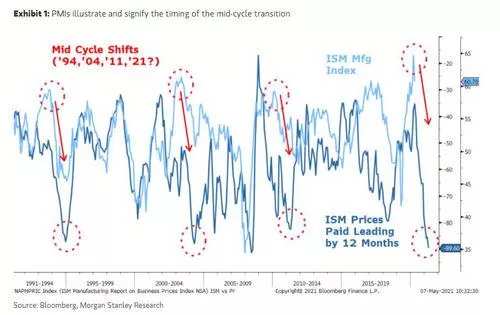

Mr Wilson said Morgan Stanley's so-called medium-term transformation was essentially preparing for the coming tightening, which was "in line with our judgment about stock market volatility and the 10% to 20% consolidation of market indicators this year".

Many traders will not forget the thrilling scene of 2013, when bond yields soared under the "curtailment frenzy", creating the risk of asset selling, and there was a heated debate in the financial media. the Fed and its endorsements stress that "austerity is not austerity", and anyone else who has a brain will think this is nonsense.

In the twinkling of an eye, Morgan Stanley's Wilson (Michael Wilson) has once again opened the old scars of the Fed and its mindless supporters, pointing out in its weekly Weekly Warm Up report that "contraction is tightening," but added that the surprise of the market after last week's Fed meeting and the corresponding wild swings were unnecessary, because in fact, tightening had already begun months ago.

Wilson, who became the most pessimistic of Wall Street's heavyweight strategists a few months ago, wrote in his report that while the Fed surprised most people in the market by "starting" to talk about austerity this time, the reality is that the market has been preparing for the inevitable process several months ago, and the market itself is the best evidence. Mr Wilson said Morgan Stanley's so-called medium-term transformation was essentially preparing for the coming tightening, which was "in line with our judgment about stock market volatility and the 10% to 20% consolidation of market indicators this year".

Given that the M2 money supply has slowed, Mr Wilson predicts, "it will be the way down the hill from now on". In other words, unless the Fed injects another wave of explosive liquidity into the system, such a shift will not change course.

Wilson went on to discuss it in detail. He pointed out that while the Fed's meeting last week brought more uncertainty to the market, at least one thing has become more obvious: "as far as this monetary easing cycle is concerned, we have reached the point where we are going down from the top of the mountain. "

Mr Wilson points out that, as he predicted, what the Fed is doing now is "a typical medium-term transition, so investors should not have been too surprised when they tried to start a long-term tightening process".

After all, the US economy is recovering strongly, and nominal GDP growth is expected to be close to 10 per cent this year, the only performance seen since 1984. At the same time, whether inflationary pressures are temporary or long-term, everyone must admit that prices are now rising sharply and that future inflation will exceed what the Fed and most others expected six months ago. In other words, facts and data have changed, so the Fed's policy must change as a result. "

However, in any case, the market reacted shockingly last week, and if you look at the stock and bond markets alone, it looks as if the Fed has already started to raise interest rates-despite the fact that they have not raised interest rates. and the quantitative easing program of more than $2 trillion has not changed. The storm began in the bond market, where yields on 10-year Treasuries and break-even inflation fell sharply. By Wednesday afternoon, however, break-even inflation fell even harder, at one point nearly 20 basis points below the 10-year real interest rate.

Interest rates rebounded slightly on Thursday and Friday, which seems to have formed a very solid foundation, and as the economy continues to recover and the Fed continues to turn, there is a good chance that interest rates will start to rise from then on. In Wilson's view, "this scene looks quite similar to 2013, the year after the Fed peaked." At the time, the symbol of the Fed's peak was the third round of quantitative easing announced on September 12, 2012. For now, the symbol of the Fed's peak is the announcement of its average inflation target last summer.

This means that there is a significant difference between the current situation and the frenzy of retrenchment in 2013: at the beginning, "tapering" quantitative easing was a new concept for the market, and when Bernanke mentioned this in congressional testimony on May 22, the market is naturally more shocked than it is today. Now, by contrast, the market fully understands the meaning of contraction and assumes that this day will come sooner or later as the economy recovers. In short, while the path to higher real interest rates will not be as dramatic as in 2013, the prospect of higher real interest rates will still have a corresponding impact on all risky asset markets, including the stock market.

This is Morgan Stanley's judgment.

The chart above shows the changes in real interest rates before Bernanke testified in May 2013, showing that "things may not be as surprising as they seem, at least the markets should not be so surprised." We believe that the situation is the same today.

"in our view, with economic data so strong, it would be naive to think that the Fed will not gradually shrink in the coming months. In fact, the idea that the Fed has never thought about it or discussed it is absurd. Obviously, the market understands this, so last week's situation is hardly surprising. This is all part of the medium-term transition, which began months ago, with intense price volatility and a shift in market leadership. "

Early in the cycle, stocks underperformed the market, which is also a typical sign that the market "got the information". In any case, based on Wilson's contacts with clients over the past few weeks, there is no consensus on this view. It is true that most people are not ready to deal with the tightening of monetary policy, nor do they think that they need to worry about it, until reality caught them by surprise.

Mr Wilson points out that, contrary to what these people think, if you choose the right indicators, you will find that monetary tightening has actually begun months ago. The Austrian chief equity strategist at Morgan Stanley points out that this indicator is money supply growth.

"at present, central banks in almost all advanced economies in the world are adopting zero or even negative interest rates, so the best indicator to determine that monetary policy is becoming looser or less relaxed is money supply growth. "

While many Keynesian believers may have different views on this point, Wilson stressed that "this is the case now, and financial markets seem to agree with it." He explained:

"when the money supply accelerates, assets that are more speculative, or riskier, tend to outperform the market, and when that rate slows, these assets run into trouble. As we have pointed out many times over the past few months, the growth rate of the Fed's balance sheet (M1) peaked in February, and it is at this point that many expensive, speculative stocks that have risen largely on the Fed's balance sheet over the past 12 months have also peaked. Interestingly, as shown in the chart below, at a time when M1 growth tends to be flat, these stocks are showing better stability, although prices are still below their previous highs. "

Wilson then explained why it is almost impossible for the Fed to track changes in the total M2 money supply every week, but can only update it every month.

From Wilson's point of view, it is clear that the growth rate of M2 is more important than M1, which is the net liquidity available to the economy and the market. In this regard, the deceleration also began in late February, but the curve has not yet flattened, and there seems to be room for further fall, such as a more "normal" annual rate of 7% to 8%.

That means liquidity will tighten further when the Fed does start to shrink later this year or early next year.

Finally, the following chart shows M2 data at the global level, which is broadly similar to that of the United States.

Wilson concluded that, long before last week's "shocking" move by the Federal Open Market Committee, the market actually began to readjust cognitive interest rates since the Fed's balance sheet expansion slowed significantly. closer to the medium-term transition goal. At the same time, M2 growth is slowing at a similar pace, and there is room for further downgrade, especially after the Fed actually starts to shrink later this year or early next year. Finally, global monetary growth has also begun to decline from high levels, with everyone's major economies involved in the process.

In Mr Wilson's view, the scene is "reminiscent of the rolling consolidation of risky assets in 2014 and 2018", and he believes the trajectory of the market movement in 2021 is roughly the same.

To sum up, Wilson wrote: "contraction is austerity, but the tightening process actually begins at a time when the rate of money supply growth changes." The good news is that the market already knows this. The bad news is that a large number of investors seem to have noticed after the Fed surprised them last week. This means that the consolidation of asset prices is far from over, with more cyclical and reflationary assets bearing the brunt in the coming weeks. "

In fact, the really interesting thing is what happens after Wilson's predicted 20% consolidation. For example, will the whole hawkish tone of the Fed disappear? Will they turn to super doves again, creating the last and biggest asset bubble?

Edit / isaac