2 Reasons to Buy AMD, and 1 Reason to Sell

Advanced Micro Devices (NASDAQ: AMD) has had one incredible year. The price of its shares has almost doubled in 2023, increasing 98% as of this writing. Indeed, when ranking all S&P 500 components by year-to-date performance, AMD ranks seventh -- overshadowed only by 2023 fireballs like Nvidia and Meta Platforms.

At any rate, as the year draws to an end, investors want to know if the good times will continue for AMD. Here are two reasons to think they will -- and one reason to believe they won't.

Reason No. 1 to buy: AMD's latest AI chip is a beast

If there's one reason to buy AMD right now, it's artificial intelligence (AI). It seems that right now, every single day brings a new AI innovation. This means demand for the semiconductors that power AI supercomputers is booming.

Crucially, only a few companies design the graphics processing units (GPUs) favored by software designers that train the large language models (LLMs) behind today's cutting-edge AI. One of those companies is Nvidia. Its H100 GPU is the most-sought AI chip around. It often sells for tens of thousands of dollars, and wait times for new deliveries can be months long.

That's why AMD's latest chip offering could be such a game changer. On Dec. 6, the company debuted its new MI300X chip. With it, AMD aims to compete directly with Nvidia's H100. According to AMD, the MI300X is faster than the H100 and delivers up to 60% increased performance.

If those performance figures bear out, it could be a boon for the AI sector in general -- and AMD in particular. With demand for generative AI through the roof, AMD could see a windfall in sales and profits if it were to unseat Nvidia as the king of AI chips.

Reason No. 2 to buy: Customers are lining up for its new AI chips

At any rate, there's little doubt there will be a significant market for the MI300X. Even if the chip doesn't live up to AMD's hype, there's still a huge supply and demand mismatch within the industry. And with the MI300X, AMD is poised to increase supply and capture market share.

To that end, this is what AMD CEO Lisa Su said during the MI300X introduction:

We are seeing very strong demand for our new Instinct MI300 GPUs, which are the highest-performance accelerators in the world for generative AI. We are also building significant momentum for our data center AI solutions with the largest cloud companies, the industry's top server providers, and the most innovative AI start-ups -- who we are working closely with to rapidly bring Instinct MI300 solutions to market that will dramatically accelerate the pace of innovation across the entire AI ecosystem.

Customers are already on board with the new MI300X. Microsoft has announced that its new Azure virtual machines, designed for AI applications, will use the new AMD chips. In addition, AMD noted that Meta, Broadcom, and Cisco, among others, are working with AMD to develop advanced AI systems.

In short, there's plenty of room for AMD in the AI chip market. So, while the jury's still out on whether it can take significant market share from Nvidia, there's little doubt that the MI300X should provide a substantial boost to AMD's top and bottom lines.

One reason to sell: Valuation

Growth is one of the hardest things to find on Wall Street, which is why investors often have to pay up to get it. That's certainly the case for AMD.

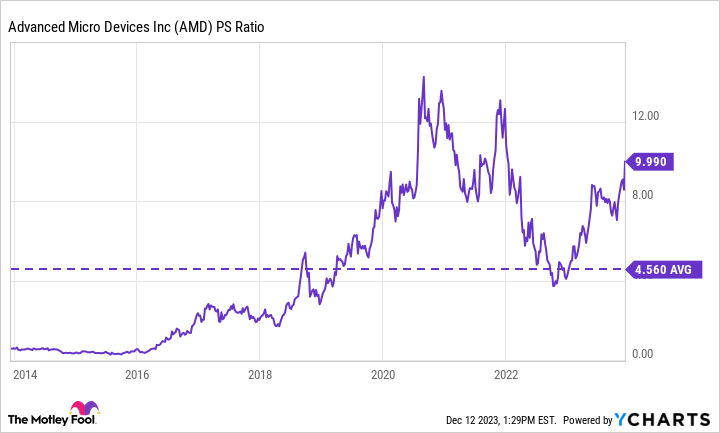

The company's shares now trade at a price-to-sales (P/S) ratio of 10. That's the highest level since early 2022, and more than double the stock's 10-year average P/S ratio of 4.5.

In part, that's why AMD, despite its great leadership and solid growth prospects, isn't a fit for every investor. Its high valuation, combined with its reliance on a booming tech market, will rule it out for value-oriented investors or for those who already have a large concentration in the semiconductor industry or tech stocks in general.

However, for growth-oriented investors willing to hold for the long term, AMD should remain a name to watch. Thanks to its new AI chip, the company is well positioned to take the fight to Nvidia, which could send its stock much higher in the years to come.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Advanced Micro Devices wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 11, 2023

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Jake Lerch has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Cisco Systems, Meta Platforms, and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

2 Reasons to Buy AMD, and 1 Reason to Sell was originally published by The Motley Fool