The anti-ARKK ETF gets off to slow start with just $4.7 million

Cathie Wood famously has no shortage of critics. Yet a new ETF betting against her beloved tech companies is drawing muted investor interest thus far -- even as the strategy delivers a tidy 2.8% in its first few days.

Since its Tuesday debut, the $Tuttle Capital Short Innovation ETF(SARK.US$, an exchange-traded fund that delivers the inverse performance of Wood's flagship $ARK Innovation ETF(ARKK.US$, has received a modest $4.7 million assets.

- according to data compiled by Bloomberg.

That's no disaster for a new ETF -- many take time to fire up the Wall Street money machine. But early indications suggest there's no big rush to use the product in order to short expensive growth companies favored by the Ark Investment Management founder.

After a gangbusters 2020, ARKK is down 6% this year.![]()

![]()

While many of her picks have been misfiring of late, Wood frequently emphasizes she has at least a five-year time horizon and that Ark's disruptive bets can be volatile. Often the money manager will use pullbacks as a buying opportunity.

$Tuttle Capital Short Innovation ETF(SARK.US$, originally due to be called , seeks to track the inverse of ARKK performance through swap contracts. It rose 2.9% on Wednesday as ARKK dropped 3.3%, and slipped 0.4% Thursday as the Ark fund climbed 0.7%.

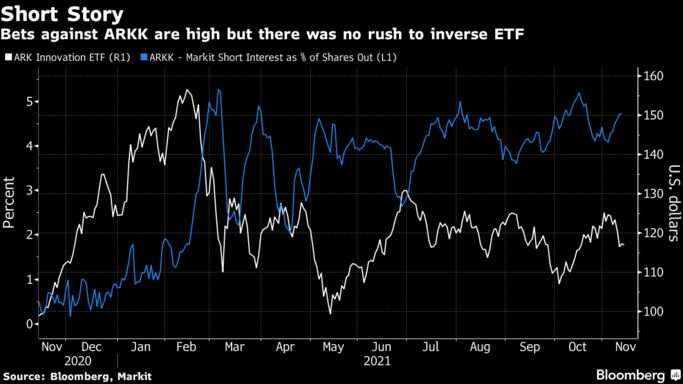

Many traders continue to wager against $ARK Innovation ETF(ARKK.US$ directly by borrowing shares. Short interest in the $20 billion product is at around 4.7% of shares outstanding.

-according to data from IHS Markit Ltd.

That's not far from its peak of around 5.3% in March. Still, many other ETFs see much higher levels. Short interest for the $Ishares Iboxx $ High Yield Corporate Bond Etf(HYG.US$, for example, is currently around 22%.

Will you invest in ARKK or SARK?![]()

![]()

Source: Bloomberg

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Money--Max :

102550193 : Interesting

牛3姐 :

Koolgal : I prefer ARKK

BaldoRocks :

Win or Lost : Buy on dips

Rocket Man : Nice share