$Shopify Inc(SHOP.US)$ announces its next round of earnings this Wednesday, July 28. Here is everything that matters.

Net Income, Earnings, And Earnings Per Share

Earnings and especially earnings per share (EPS) are useful measures of a company's profitability. Total earnings, which is also referred to as net income, equals total revenue minus total expenses. EPS equals to net income divided by the number of shares outstanding.

Earnings And Revenue

Wall Street expects EPS of $0.96 and sales around $1.04 billion. Shopify reported a per-share profit of $1.05 when it published results during the same quarter last year. Sales in that period totaled $714.34 million.

What Are Analyst Estimates And Earnings Surprises, And Why Do They Matter?

Wall Street analysts who study this company will publish analyst estimates of revenue and EPS. The averages of all analyst EPS and revenue estimates are called the "consensus estimates"; these consensus estimates can have a significant effect on a company's performance during an earnings release. When a company posts earnings or revenue above or below a consensus estimate, it has posted an "earnings surprise", which can really move a stock depending on the difference between actual and estimated values.

Wall Street analysts who study this company will publish analyst estimates of revenue and EPS. The averages of all analyst EPS and revenue estimates are called the "consensus estimates"; these consensus estimates can have a significant effect on a company's performance during an earnings release. When a company posts earnings or revenue above or below a consensus estimate, it has posted an "earnings surprise", which can really move a stock depending on the difference between actual and estimated values.

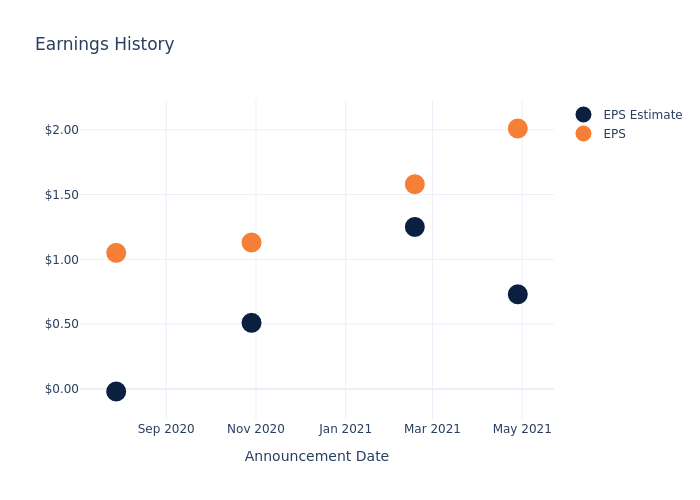

The Wall Street consensus estimate for earnings would represent a 8.57% decrease for the company. Revenue would be have grown 45.59% from the same quarter last year. The company's reported EPS has stacked up against analyst estimates in the past like this:

| Quarter | Q1 2021 | Q4 2020 | Q3 2020 | Q2 2020 |

|---|---|---|---|---|

| EPS Estimate | 0.73 | 1.25 | 0.51 | -0.02 |

| EPS Actual | 2.01 | 1.58 | 1.13 | 1.05 |

| Revenue Estimate | 865.48 M | 910.22 M | 653.22 M | 505.08 M |

| Revenue Actual | 988.65 M | 977.74 M | 767.40 M | 714.34 M |

Stock Performance

Shares of Shopify were trading at $1582.28 as of July 26. Over the last 52-week period, shares are up 50.64%. Given that these returns are generally positive, long-term shareholders are probably satisfied going into this earnings release.

Comment(0)

Reason For Report